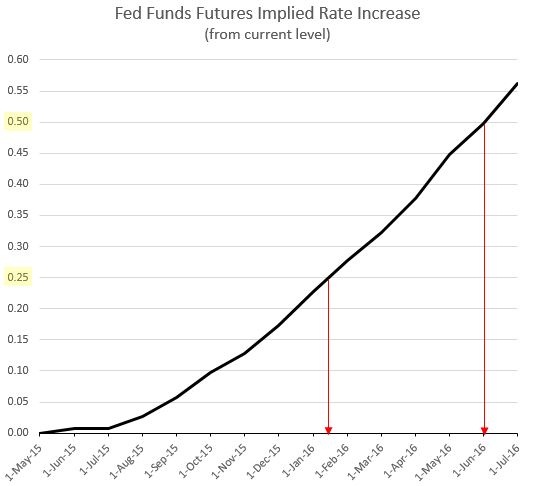

Rate hike expectations have shifted considerably with relatively dovish commentary from FED policymakers and weaker than expected economic releases from US.

- As of now market is predicting first rate hike of 25 basis points in January 2016, followed by second rate hike in June 2016. Chart courtesy SoberLook.com.

As of now, Federal Reserve policymakers have indicated that any move would be data driven and now with market predicting no hike this year it is a challenge for policymakers whether to act ahead of market expectation. Most of the officials so far seems to have agreed on at least one rate hike this year and March's Fed funds rate projection by participants indicate still 50 basis points hike.

June meeting turns crucial -

- With data faltering to downside, FED will have to clearly communicate what it might be doing this year, any hawkish indication could result in severe market swings given no hike expectation this year.

- Moreover FED will publish participant's projection for growth, inflation and fed funds rate, which will be closely watched. If projection still maintains upbeat forecast with 50 basis points hike signal would be very hawkish and dollar and short term treasury yield will more likely shoot up. However as of now that doesn't look to be very probable.

Federal Reserve will hold press conference post policy announcement on June 17th after two day meeting.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?