In spite of stronger signal from US Federal Reserve last month, over the possibility of a rate hike in its December meeting doubts continue to persist as data from US fails to match expectation. There is no doubt that US economy is growing and labour market is somewhat tightening as unemployment rate reaching to its longer run normal level of 5% but there is going concern regarding inflation, which has been running well below FED's target of 2%.

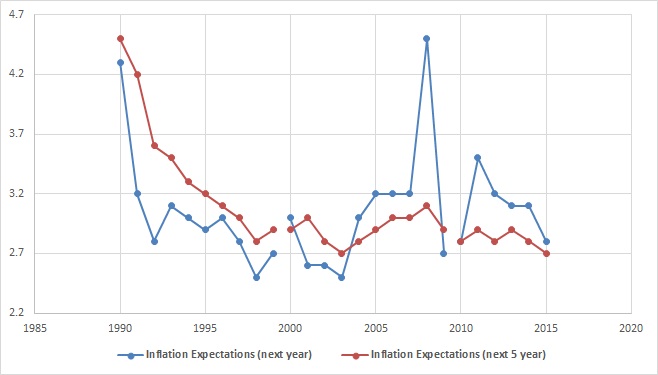

And latest consumer survey by Michigan University that has been released last Friday is not making it easy for FOMC policymakers. Longer term inflation expectations (5 years and beyond) has dropped to the lowest level in more than a decade.

- Consumer inflation expectations for next year has dropped to 2.8%, lowest level since 2010 and expectation for five years dropped to 2.7%, lowest level since 2003.

In most of the FED communication so far, FOMC suggested that longer term expectation has remained well anchored. Survey showed inflation expectations never dropped below 2.8% except for this year.

However a rate hike still likely from the FED given the progress of the economy since 2009, which warrants increase in real rates from current negative level.

Dollar index, is currently trading at 96.7, down -0.15% so far today.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?