FOMC will conclude its two day monetary policy meeting today and will announce the decision at 18:00 GMT, which will follow press conference from FED chair Janet Yellen at 18:30 GMT.

While whole financial market will be watching, all are divided in their opinion about today's meeting.

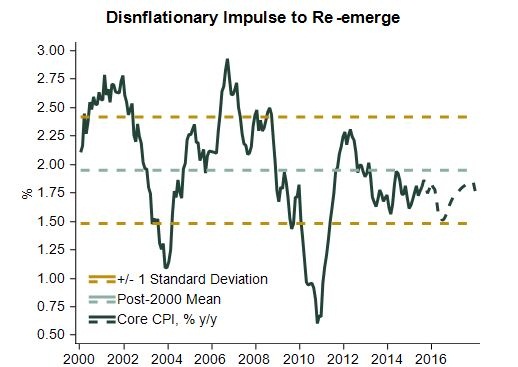

While FED has reached close to maximum employability, doves are pointing out that inflation remains way below FED's mandate which is 2%.

Key arguments -

- Inflation has remained well below FED's mandate of price stability with medium term inflation at 2%. Argument is that while lifting interest rates is an effective weapon to fight inflationary threat, premature rise might push the economy back towards deflation as inflation is no-where to be found.

- Doves' sight yesterday's CPI report, which shows that headline CPI has moved to deflationary territory. Headline CPI for August was -0.1%. Hiking rates now might provide negative message of unnecessary action and FED will hike anyway.

- The chart plots US's core inflation, which is showing downward bias. Analysts at TD securities are calling for restrain from FED and inflation according to them is clearly on downward trajectory and might drop as low as 1.3% by courtesy TD securities and financial times.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand