FOMC will conclude its two day monetary policy meeting today and will announce the decision at 18:00 GMT, which will follow press conference from FED chair Janet Yellen at 18:30 GMT.

While whole financial market will be watching, all are divided in their opinion about today's meeting.

While arguments are strong for both the sides here I would like to highlight a key factor that might make a difference in today's FOMC decision.

Key arguments -

- In anticipation of a rate hike from FED, credit and financial conditions have strengthened considerably. Arguments are that though one 25 basis points hike may not make much of a difference, it is likely to setoff expectations for further tightening and shorter run rates, which have already moved up considerably, will break above its recent high and tighten conditions globally.

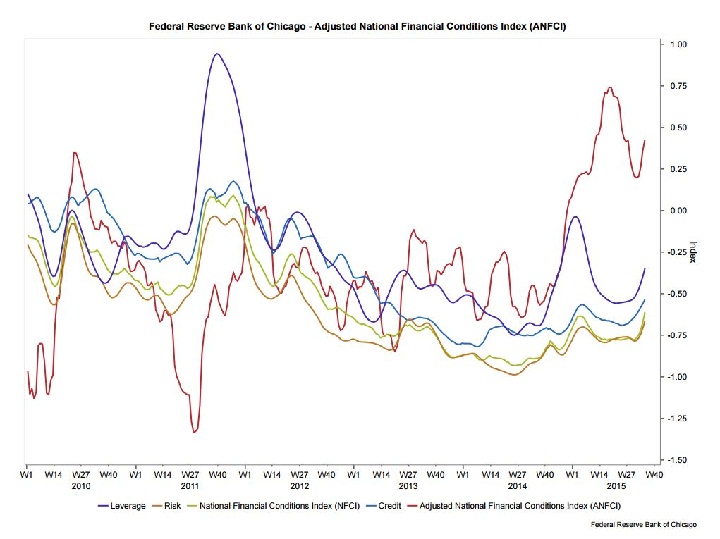

- As shown in the chart, Federal Reserve Bank of Chicago's own measure, Adjusted National Financial Conditions Index (ANFCI), a gauge of financial condition in debt and equity markets has already tighten considerably. Argument is that an earlier than required rate hike might even push it to new high.

- Financial conditions have already reached its tightest level since 2008/09 crisis.

- Tightening is being seen across credit, risk and financial leverage. Argument is that FED should communicate to sooth the conditions, instead of hiking rates.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand