FOMC will conclude its two day monetary policy meeting today and will announce the decision at 18:00 GMT, which will follow press conference from FED chair Janet Yellen at 18:30 GMT.

FOMC doves have increasingly pointed out that inflation is running well below Committee's medium term objective of 2%, however hawks would like to point out that the reason to be lower oil price.

Key arguments -

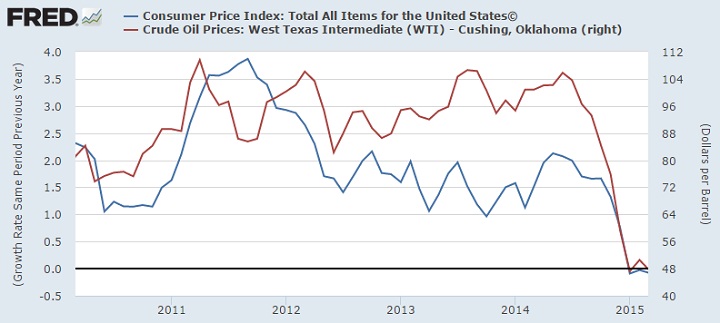

- It is a fact that current low level of inflation has given opportunity to FED to hold rates at low for some time further, however that privilege might have given by oil. Argument is that the chart shows how interconnected headline inflation is to lower oil/energy prices. So the privilege given by oil, can also be taken away with a sharp rise.

- If energy prices rise fast, FED might have to pull triggers more quickly. So a rise today, provides FED with extra room for subsequent hikes.

- Crude price rise would in future might lead to tightening of policy globally, so a hike then could cause more trouble than now.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand