How can improve odds on GBPAUD call backspreads?

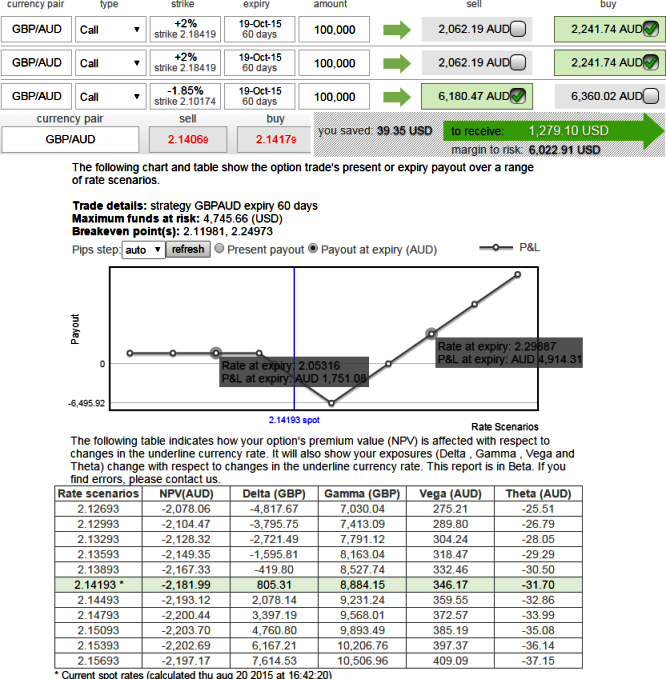

Delta & Gamma: As you can point out from diagrammatic representation of this bullish strategy, the spread is delta neutral through slightly positive (0.008) or close zero delta, while gamma is 0.08 which would imply that spread benefits if GBPAUD experiences upswings, if it drops down then there would be any harm to this portfolio but the profitability reduces.

Implied Volatility and Vega: The spread would gain from any increase in implied volatility as is evident from positive vega at 395.

When this position is executed, if within short term the underlying exchange rate progresses to OTM strikes (2.1841) where we added longs, this trade may actually be profitable if IV increases. But if it hangs around there too long, time decay will start to hurt the position. You generally need the stock to continue making a bullish move well past strike B prior to expiration in order for this trade to be profitable.

Threat for the position: Theta has been the real treat as the strategy contains more longs than shorts and theta has been negative here.

Hence, the maximum loss for the call back spread is limited and is taken when exchange rate of GBPUSD at expiration is at the strike price of the long calls purchased. At this price, both the long calls expire worthless while the short call expires in the money.

FxWirePro: Strategy optimizer through Black Scholes – a run through of GBP/AUD call backspread

Thursday, August 20, 2015 12:08 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?