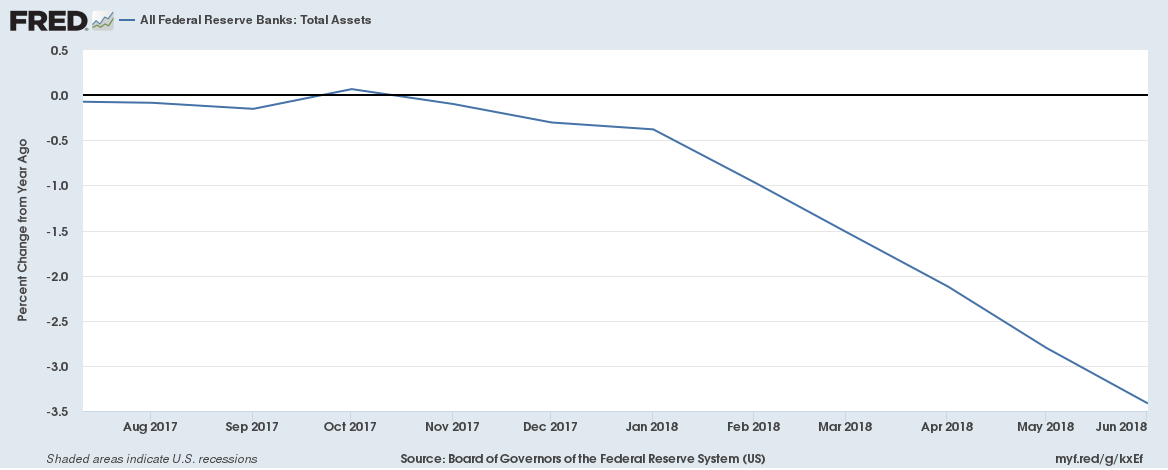

The Fed’s balance sheet reduction, which is one of the key reasons for dollar liquidity drain from the financial systems is gathering pace and soon it would hit its peak of $50 billion per month. The balance sheet reduction began last year in October with $10 billion per month and as of this month, it has gradually increased to $40 billion per month and in October the pace would hit $50 billion per month, which is the announced ceiling rate of reduction by the U.S. Federal Reserve.

The chart shows that the size of the balance sheet is down 3.42 percent from a year ago but with balance sheet reduction gathering pace, we expect that number to reach as high as 25 percent, just like it did when the Federal Reserve was purchasing assets at the pace of $600 billion per annum.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons