The improved US economic data means that it is almost impossible to justify keeping interest rates at near-zero. Whether the first hike is this week, or at either the October or December meetings, lift-off is surely coming soon. The first hike from the Fed since the global financial crisis will signal the end of the era of "cheap money".

The opening move is likely to be just 25 basis points (raising the target range for the Fed funds rate from 0-0.25% to 0.25-0.5%). The Fed would be likely to use the accompanying statement to emphasise that rates will rise only gradually, and only if economic and market conditions allow.

Admittedly, a number of Fed officials clearly want to use the recent volatility in financial markets as a reason to delay the first rate hike again. Some analysts do not expect the gradual return of US interest rates to more normal but still low levels to be the seismic shock that many seem to fear. The markets and most analysts now appear to expect the Fed to hold fire and many observers (including the IMF) have argued for a delay.

Raising rates now would therefore send a strong signal that the Fed is unlikely to be deflected from further tightening by additional market volatility or events overseas, unless these represented a much greater threat to the US economy. Indeed, once the dust has settled, the combination of a small hike and a relatively dovish statement may be better received than yet another delay.

"In fact, the Fed is expected to hike rates more aggressively than the markets anticipate. But the crucial point is that this is dependent on a continued improvement in the US economy, a pick up in price pressures and relative calm in the markets. If conditions deteriorated again, we would expect the Fed to pause too", says Capital Economics in a research note to its clients.

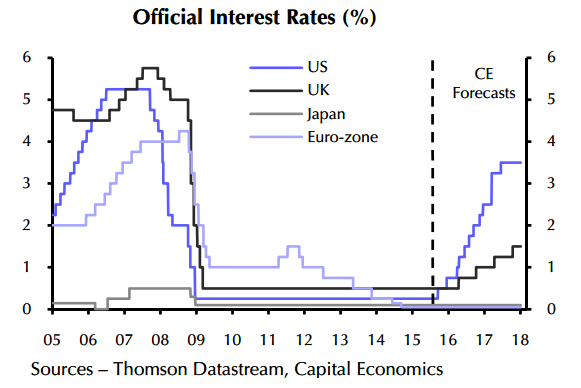

With higher US rates and a stronger USD, there is plenty of scope for looser monetary policy in other parts of the world. Monetary policy is likely to remain loose in much of the rest of the world, or even be eased further - notably in China, the euro-zone and Japan. The Bank of England might be one of the first to follow the Fed's lead, but is still likely to wait until 2016 and move much more slowly thereafter.

At 1015 GTM, the dollar was down around 0.5 percent to 119.56 yen, while the euro traded 0.13 percent lower at $1.1313, having risen to $1.1373 on Monday, its highest since Aug 26th.

Fed rate hike to give more scope for looser monetary policies in other parts of the world

Tuesday, September 15, 2015 10:52 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary