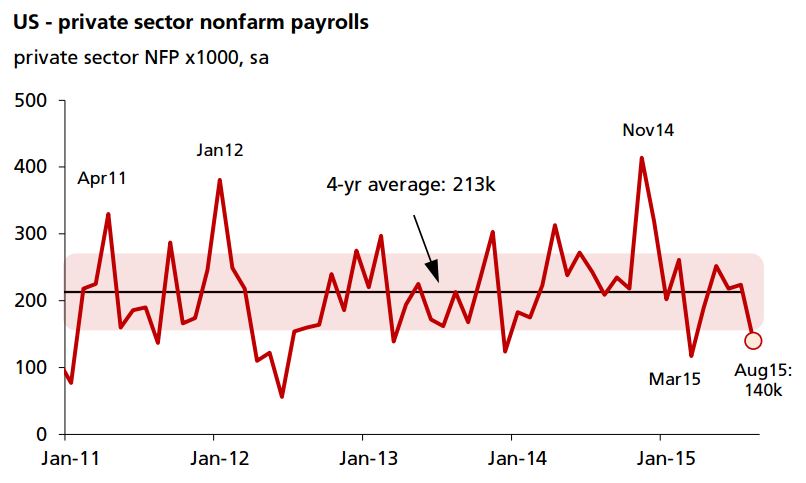

Private sector payrolls are back at 140k, core PCE inflation has dropped to 1.2% YoY, growth in the first two quarters of the year has averaged 2.1% (QoQ, saar), core capex expenditures haven't grown one iota in 3.5 years. And the most recent Fed rhetoric, including from Lockhart last Friday is: it's time to raise rates?

The reason used to be because job growth was picking up and that would drive inflation higher. But job growth was never really picking up, it was just bouncing around. And lately it's bounced pretty hard the wrong way.

"We're not too concerned about it - the 140k in August is probably just normal volatility. But it underscores the fact that all the Fed talk last year about 'better job growth' wasn't based on the data, it was just talk," DBS Bank says.

The reason to hike today is still because 'inflation is going to go up' - it's just that the 'better jobs growth' part is left out of the equation. Or knocked down by a first difference. Steady growth is good enough, it is said. Inflation is still going to go up. Yes, slack is being mopped up. And yes, someday inflation will go back up. But when? 2016? 2018? The Fed's favourite inflation gauge is down to 1.2% and it's falling - been falling for 3.5 years.

The bottom line is the Fed wants to hike because the Fed wants to hike according to DBS Bank.

Markets don't want to fight the Fed but they don't think it will get very far. Ten-year Treasury yields are back at 2.12% and Fed fund futures markets expect only 62 basis points of hikes between now and end-2016. If the Fed gives us one hike this year, as it seems to swear it will, that leaves a hike-and-a-half for all of 2016.

"Wouldn't it be better to put that hike-and-a-half back in your pocket and hope for steady inflation and better jobs growth instead?," notes DBS Bank.

Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances

Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances  ECB Expands Euro Liquidity Backstop to Strengthen Global Role of the Euro

ECB Expands Euro Liquidity Backstop to Strengthen Global Role of the Euro  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  RBA Signals Possible March Rate Hike as Energy Risks Threaten Inflation Outlook

RBA Signals Possible March Rate Hike as Energy Risks Threaten Inflation Outlook  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Australian Central Bank Signals Tough Stance as Inflation Pressures Persist

Australian Central Bank Signals Tough Stance as Inflation Pressures Persist