Foxconn International, which is known as Hon Hai Precision Industry Co., Ltd. in China and Taiwan, has pulled out from its joint venture deal with Vedanta Limited, a leading natural resources conglomerate in India.

The Taiwanese semiconductor firm withdrew from its $19.5 billion project, and this turn of events was described as a huge blow to Prime Minister Narendra Modi's chip manufacturing plans for his country. According to Reuters, Foxconn did not say why it made this decision despite the fact that it already signed an agreement with Vedanta last year to build a chip and display manufacturing facility in India’s state of Gujarat.

Moreover, it was reported that the country’s prime minister has made chipmaking a top priority as part of his economic strategy for India. He is pushing forward with his plan of making a "new era in electronics manufacturing, but with Foxconn's withdrawal, his ambition of attracting foreign investors for chip production has been shattered. This would have been the very first local chip production in India, but the project has failed.

"Foxconn has determined it will not move forward on the joint venture with Vedanta,” the chip maker said in a statement regarding its pull out from the chipmaking joint venture. “Foxconn is working to remove the Foxconn name from what now is a fully-owned entity of Vedanta."

CNBC reported that Foxconn said its move to drop out was a “mutual agreement” with Vedanta. While it will no longer continue with the JV, it remained confident that India will be able to achieve its semiconductor ambitions.

Foxconn is a known supplier of chips, and Apple is one of its major clients. It is working to further its reach and diversify its supply chains beyond mainland China. It was noted that the company already has several factories across India, but its canceled venture with Vedanta would have been one of its largest projects.

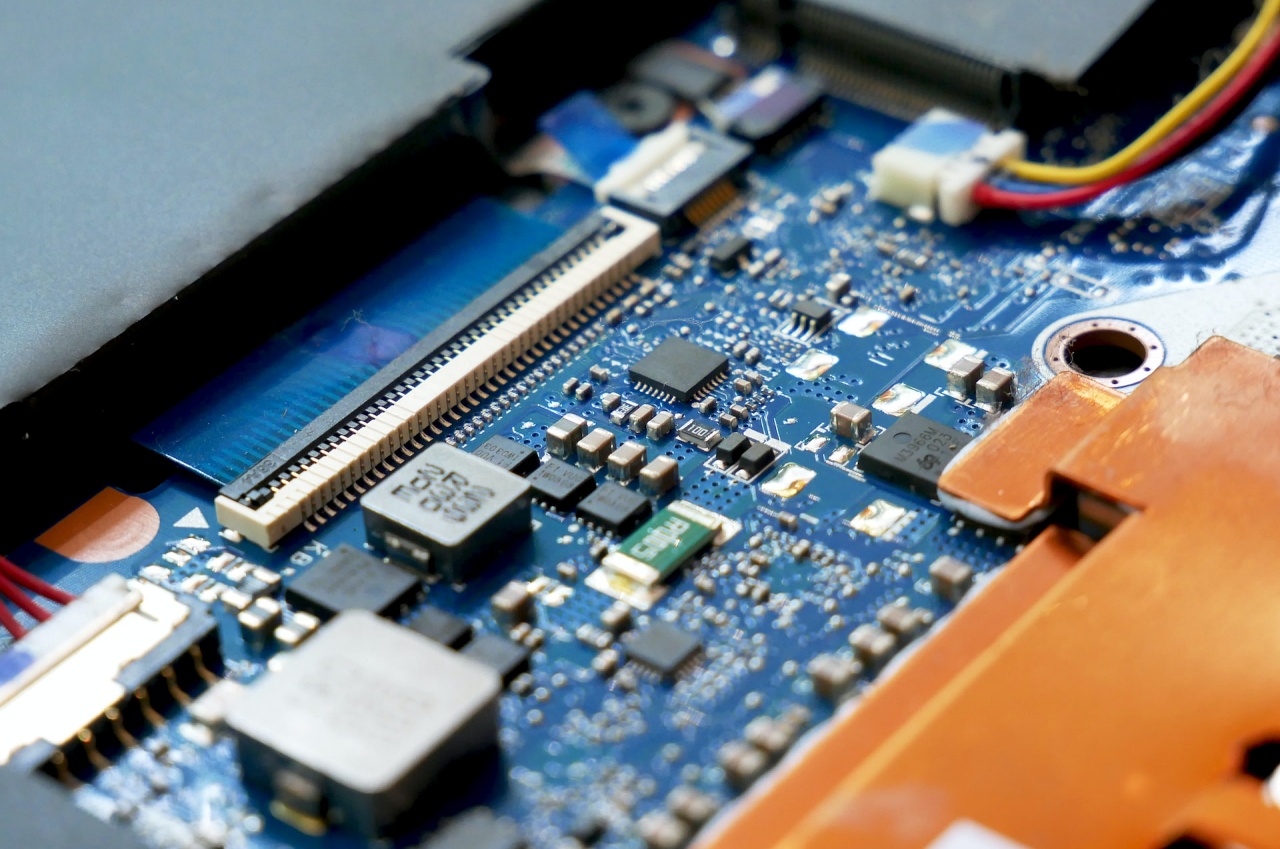

Photo by: Vishnu Mohanan/Unsplash

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns