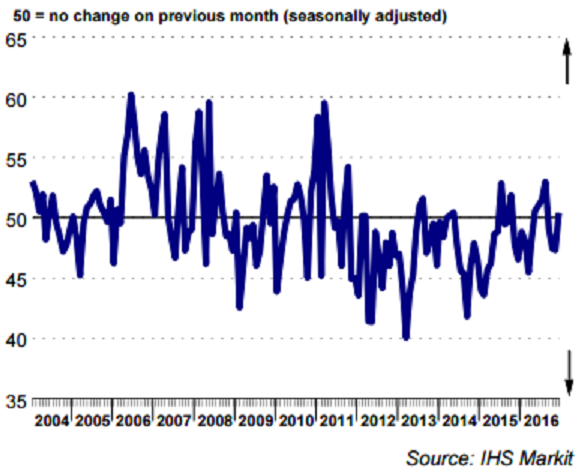

Retail sales in France increased for the first time since August last year, with the headline retail Purchasing Managers’ Index (PMI) marginally crossing the 50-point no-change mark during the month of December.

The seasonally adjusted headline Retail PMI rose to 50.4 in December, up from 47.3 in November, signalling a fractional rise in like-for-like sales. Anecdotal evidence suggested greater footfall numbers was the principal factor behind the uptick.

Nevertheless, sales remained down on an annual basis in December. Moreover, the latest year-on-year drop accelerated from the preceding month and remained marked overall. Actual sales continued to fall short of retailers’ previously set plans during December. Furthermore, the extent of the latest shortfall was greater than in the previous month.

Despite this, retailers remained optimistic that sales would exceed expectations next month. That said, the degree of positive sentiment was the lowest since July. Retail companies in France reported a rise in gross margins for the first time since January 2008 during December.

French retailers noted a further rise in whole sale costs in December. Moreover, the rate of increase was the sharpest in 11 months. In spite of a positive sales trend, firms continued to reduce their purchasing activity during December. The rate of decline accelerated from the preceding month, but was slight overall.

"The French retail sector finished the year on a positive note in December, with the first rise in like-for-like sales since August. That said, the rate of growth was fractional and sales were once again down on an annual basis. Nevertheless, increasing sales volumes and success in gaining new customers contributed to a widening of gross margins for the first time since January 2008," said Alex Gill, Economist, IHS, Markit.

Meanwhile, EUR/USD traded at 1.05, up 0.19 percent, while at 9:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at -46.06 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility