The French elections are drawing closer with each passing day and we will know how France will vote in the next couple of days. The outcome of the election could trigger shockwaves in the France's economic landscape and we can reasonably expect the shockwaves to ripple through the rest of the Eurozone. In fact, veteran investors won't be surprised if the outcome of the French election also triggers some whiplash in the U.S. This post is however more concerned with how the French economy is likely to fare after the French elections.The French elections are drawing closer with each passing day and we will know how France will vote in the next couple of days. The outcome of the election could trigger shockwaves in the France's economic landscape and we can reasonably expect the shockwaves to ripple through the rest of the Eurozone. In fact, veteran investors won't be surprised if the outcome of the French election also triggers some whiplash in the U.S. This post is however more concerned with how the French economy is likely to fare after the French elections.

Here's how the pendulum might swing for the French banks

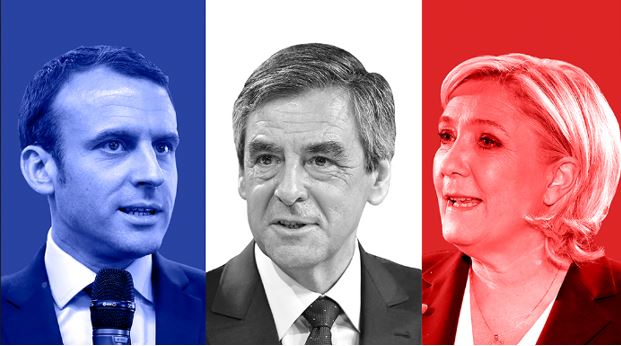

French banks are most vulnerable as the elections draw closer because of how the leading candidates on the far right and far left could move the economy. French economists will hope that a conservative/centrist candidate wins the election – at least to provide a voice of reason amidst the extremist views on the right and left.

Simon Tucker, an analyst at Saxon Trade observes that "French bank giants Societe General and BNP Paribas have been suffering wild swings since February when the campaign of the conservative candidate, Francois Fillon suffered a scandal." The chart below shows how both French banking giants have fared in the year-to-date period.

From the chart, you'll observe that the shares of BNP Paribas have only managed to creep up 1.67% after dropping by more than 10% in March. The share price of Societe General is down a massive 8.36% in the year-to-date period. The weakness in French banks underscores the prevailing sense of apprehension in the French economic landscape and in the larger Eurozone. For one, the extremist views in France suggest that a 'Frexit' might trigger the breakup of the EU.

From the chart, you'll observe that the shares of BNP Paribas have only managed to creep up 1.67% after dropping by more than 10% in March. The share price of Societe General is down a massive 8.36% in the year-to-date period. The weakness in French banks underscores the prevailing sense of apprehension in the French economic landscape and in the larger Eurozone. For one, the extremist views in France suggest that a 'Frexit' might trigger the breakup of the EU.

The effects of the 2016 Brexit vote are still fresh in the mind of investors who had to contend with the historical decision of Britain to leave the EU. After the Brexit vote, the pound crashed to a 31-year low and the European market indexes suffered massive losses. The Brexit vote also emboldened populist and nationalist sentiments across the European continent.

Investors are worried about increased uncertainties

The upcoming French election is being hotly contested between far-right's Marine Le Pen and Jean-Luc Mélenchon who is flying the flag for the far-left. The French electorate are practically equally divided between supporting the far-right and far-left candidate – electoral surveys indicate that only a silent minority of voters are leaning toward centrist candidates.

Investors are mostly worried that the election is forcing them to choose between the lesser of two evils and they won't hesitate to exit at the first sign of trouble. To start with, the far-right candidate is proposing economic policies that could cripple the French economy. The far-left candidate on the other hand is proposing foreign policy that could further weaken the EU.

The first round of the elections will hold on April 23 but it is shaping up to be one of the most unpredictable elections in French political history. In a field of 11 candidates, many stakeholders are hopeful that at least one of the mainstream (center-leaning) candidates will make it through to the second round of the election on May 7. However, if both extremists candidates make it to the second round of the elections, investors won't need anybody to tell them that they are sitting on a keg of economic gunpowder.

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape