This week, Former bond manager of PIMCO, Bill Gross, who as of now is managing unconstrained bond portfolio at Janus capital, suggested that German bund at some point early could pose historic opportunity to go short.

- It may not make sense to keep lending Germany at such low rates. Yields remain at high risk, should inflation in Euro zone pick up pace.

- Cost could also be high for Germany, should Greece choose to leave Euro zone.

French bonds share all the similar risks with German counterparts and France's economic woes make French bonds better bets.

- France is running larger twin deficit than Germany. As of latest Euro Stat report Germany register 0.7% budget surplus, compared to France's 4% deficit, both as a % of GDP.

- Moreover, French officials clearly lack motivation to push through important reforms and budgetary reduction and in turn expects to reduce the ratio due to pickup in growth, driven by European Central bank's monetary policies.

- French finance minister, Mr. Sapin, in his latest budgetary proposal suggested 0.5% reduction in deficit against request of 0.9% by Brussels.

- Yesterday, preliminary release of Markit PMI showed French economic conditions deteriorated in April, with manufacturing PMI dropping to 48.4 from 48.8 and services PMI dropping to 50.8 from 52.4 prior.

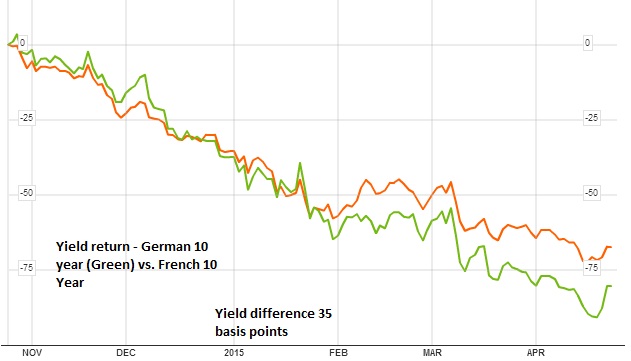

Shorting French bonds against German counterpart over longer horizon, still remains very attractive trade.

Yield difference between German and French 10 year has widened to 35 basis points from around 17 basis points in January.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?