Economic growth in France recovered during the third quarter of this year, although household consumption remained stagnant during the period.

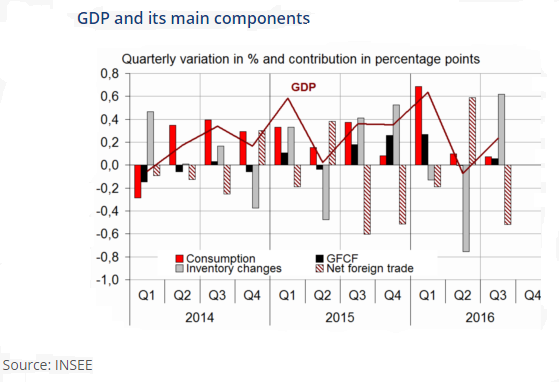

France’s gross domestic product (GDP) in volume terms during the Q3, recovered moderately by +0.2 percent, after −0.1 percent in Q2, data released by the country’s statistics agency INSEE showed Tuesday. However, household consumption expenditure stagnated for the second quarter in a row, whereas gross fixed capital formation (GFCF) increased slightly by +0.2 percent, after 0.0 percent in the previous quarter. Final domestic demand (excluding inventory changes) remained virtually stable, contributing +0.1 points to the GDP growth in Q3, as in the previous quarter.

Further, imports recovered sharply, rising +2.5 percent, after −1.7 percent slump in Q2, particularly due to purchases of raw hydrocarbons and transport equipment. At the same time, exports accelerated moderately by +0.5 percent, following a decline of 0.1 the last quarter.

Moreover, sales in food products, refined petroleum products, capital goods and other industrial goods increased but those in agricultural products tumbled. All in all, foreign trade balance weighed down on GDP growth in Q3, subtracting 0.6 points after a contribution of +0.5 points in the previous quarter.

Changes in inventories contributed to GDP growth by +0.7 points, after −0.7 points in Q2. In particular, they increased in transport equipment, raw hydrocarbons and equipment goods.

Meanwhile, the EUR/USD has formed a ‘two-crows’ bearish candlestick pattern at 1.05, while at 9:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at 41.52 (below the +75 benchmark for bullish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices