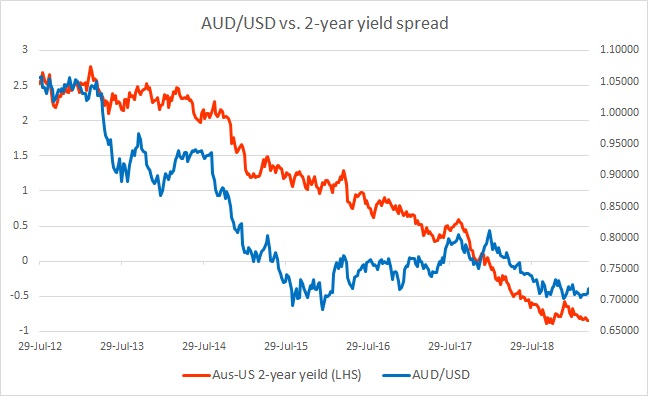

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012.

The chart above makes a clear case of closeness between the rate spread and the exchange rate. The spread between the 2-year U.S. Treasuries and the 2-year Australian government bond declined from +253 bps to -72 bps. AUD/USD responded by declining from 1.056 area to 0.729 area.

In November, we noted that the spread has reversed course and the declining Australian dollar is reducing the divergence fast and if the spread continues its reversal, at one point Aussie is likely to find support in it. The divergence got further reduced in December.

However, the reversal didn’t last long as the Reserve Bank of Australia (RBA) added dovish comments. Since the comments, the spread has again changed course and widened from just 58 bps in December to -75 bps as of February.

While the Australian dollar ticked higher the spread has further widened from -75 bps in February to -84 bps in April, in favor of the USD. If the spread continues to widen, it is likely that it would drag down the Aussie.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX