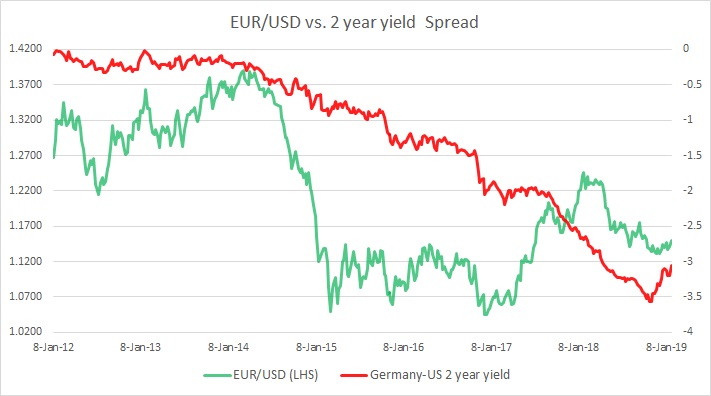

The chart above shows, how the relationship between EUR/USD and 2-year yield spread (U.S. - Eurozone) has unfolded since 2012. It is evident that these short rates have been a key influencing factor for the pair as policy divergence became evident since 2013.

The chart clearly shows the close relationship between yield spread and the exchange rate. Since December 2013, the yield spread declined from -0.2 percent area to -3.56 percent area by November 2018, and EUR/USD declined from 1.38 to 1.13 area.

However, in our December review, we noted that since the second week of November, the yield spread has reversed course, and rose from -3.56 percent to -3.26 percent, which suggests that there might be a reversal in the exchange rate going ahead, should the spread continue its reversal.

As expected the exchange rate has reversed course as the euro is currently trading 1.15 against the USD. Since our review in December, the yield spread has further narrowed in favor of the euro from -3126 bps to -305 bps. The euro is likely to rise against the USD, should the spread continue to narrow.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX