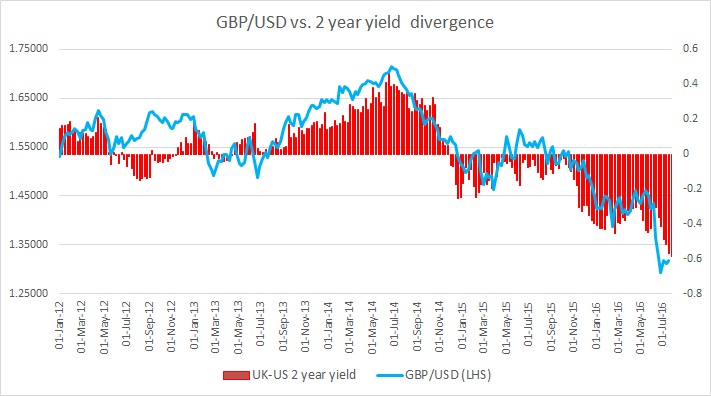

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012.

The cozy relationship between the yield spread and the exchange rate, in this case, is quite visible. Back in 2013/14, it was widely expected that UK’s economic prowess and the disappointment that the Bank of England (BoE) governor Mark Carney wasn’t as dovish as expected, fuelled the increase in yield divergence in favor of the United Kingdom and strengthening of the pound against the dollar. But as economic growth slowed and the BoE expressed a greater desire for a cautious approach, yield spread (UK-US) declined and exchange rate softened.

In 2016, the yield spread has declined sharply into the negative since the referendum date was announced. The actual decline began in September 2015 as the market was speculating that the referendum will be held in 2016, instead of 2017. The yield spread declined from -0.1 percent in September 2015 to -0.4 percent by early 2016. The spread has declined very sharply post-referendum. However, we need to note that Gilt has played the major part in this decline. Since the referendum, the yield spread has declined around 30 basis points, taking its toll on the pound.

We expect, the current high influence of yield spread is likely to continue as Bank of England (BoE) is widely expected to take some steps to ease policy further.

The yield spread is current around -0.6 percent and the pound is trading at 1.32 against the dollar.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal