Today, the bullion market prices inched higher towards $1,298, not considerably though. But bulls could not sustain the rallies despite renewed trade optimism. Despite today’s gain, the safe-haven metal still attempts to drag towards three-month lows.

Goldfields managed to produce 2.036 million ounces of gold during 2018, at all-in sustaining (AISC) costs of $981 per ounce. For 2019, the company expects to produce 2.13 million–2.18 million ounces of gold at AISC of $980-995 per ounce.

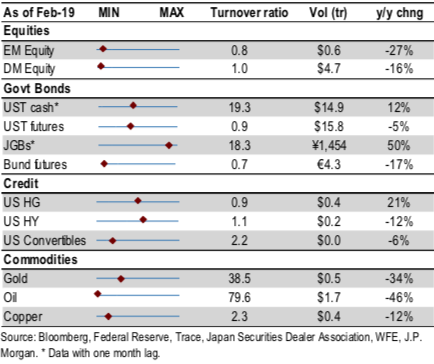

As per the trading turnover monitor, volumes are monthly and turnover ratio is annualized (monthly trading volume annualized divided by the amount outstanding).

UST Cash is primary dealer transactions in all US government securities.

UST futures are from Bloomberg. JGBs are OTC volumes in all Japanese government securities.

Bunds, Gold, Oil, and Copper are futures. Gold includes Gold ETFs. Min-Max chart is based on the Turnover ratio.

For Bunds and Commodities, futures trading volumes are used while the outstanding amount is proxied by open interest. The diamond reflects the latest turnover observation. The thin blue line marks the distance between the min and max for the complete time series since Jan-2005 onwards. Y/Y change is the change in YTD notional volumes over the same period last year.

While Gold futures & CFDs traded on the Comex division of the NYME are up about 0.2% to $1,296.50 at press time (12:40 GMT). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR is at -43 (bearish), hourly USD spot index is inching towards 83 levels (bullish), while articulating at 12:41 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays