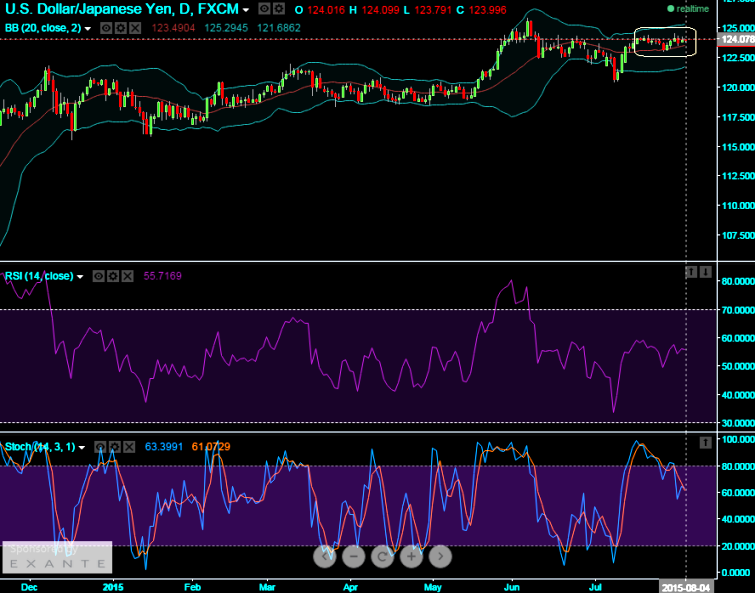

As we had anticipated earlier that the trend for this pair is going to be in tight range between 124.467 - 122.158 from last fortnight or so, look what's been happening on this pair which we've perceived this as non directional but slightly downward bias since some bearish signals (shooting star at peak on daily chart) for short term basis are popping up. Since USD/JPY's non directional pattern is persisting but some bearish candles are indicating slight bearishness, candles such as shooting star occurred at 124.126.

Option Trade Recommendation: Either Straddles or Iron-Butterfly

Why straddle shorting at this juncture: As we foresee non-directional trend along with lower implied volatility of ATM contracts at 7.58% are puzzling this pair on weekly charts we like to remain in safe zone and recommend shorting a straddle using At-The-Money options, so thereby, as prices are unlikely to behave in any dramatic ways on either side, one can benefit from certain returns by shorting both calls and puts.

But those who are highly risk averse can buy 15D Out of the money put and sell at the money put of the same maturity, simultaneously sell 15D at the money call and buy out of the money call of the same maturity. The combination carries a limited returns and limited risk that is structured for a larger probability of earning a smaller limited profit as USDJPY is perceived to have a low volatility.

FxWirePro: $/¥ portfolio reshuffling with combinations - straddles and Iron butterfly spreads

Tuesday, August 4, 2015 9:53 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate