In this write-up, we run you through the 3-way straddle options strategy that seems best suitable for EURGBP contemplating some geopolitical aspects (i.e. the UK’s parliamentary vote on Brexit that is scheduled for this week).

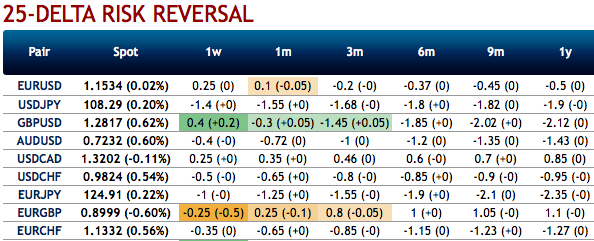

The rationale: Well, let’s just quickly glance at OTC outlook before looking at the options strategies.

Negative bids in the shorter tenors have been observed to risk reversal amid the bullish risk atmosphere in the OTC markets, this is interpreted as the hedgers are keen on bearish risks in the short-run, whereas the long-term bullish outlook remains intact.

While positively skewed IVs of 2m EURGBP contract have been stretched out on either side. This is interpreted as the hedgers bid for both OTM calls and OTM put options.

Geopolitical surface considering the UK Parliamentary developments ahead of Tuesday’s “meaningful” vote will continue to dominate the domestic focus through today’s session, as we go into the third day of debates on the EU withdrawal agreement in the House of Commons. The recent passing of two important amendments - one limiting the government’s ability to use fiscal policy in the event of a ‘no deal’ scenario (not approved by MPs) and the other requiring the government to report back to the Commons on its ‘Plan B’ within three sitting days (by 21 January) if PM May’s deal is rejected – has seen the implied bookmaker odds of a ‘no deal’ in March fall from 35% to 20%. Research by BBC Politics suggests the government may lose the vote by a 200+ margin.

In a long-run, sterling still appears to be untradeable and remains in the firm grip of the ongoing Brexit drama, amid this uncertainty, the British currency doesn’t seem to have discounted most of the bad news on current levels still.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much scepticism.

Even if you see any fresh positive bids in risk reversals to the existing bearish setup, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Options strategy: Keeping above seesaw geopolitical and hedging sentiments under consideration, 3-way straddles versus ITM calls are advocated, the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short ITM call of 2w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix and Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -54 levels (which is bearish), while hourly GBP spot index was at 98 (bullish) while articulating (at 07:03 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation