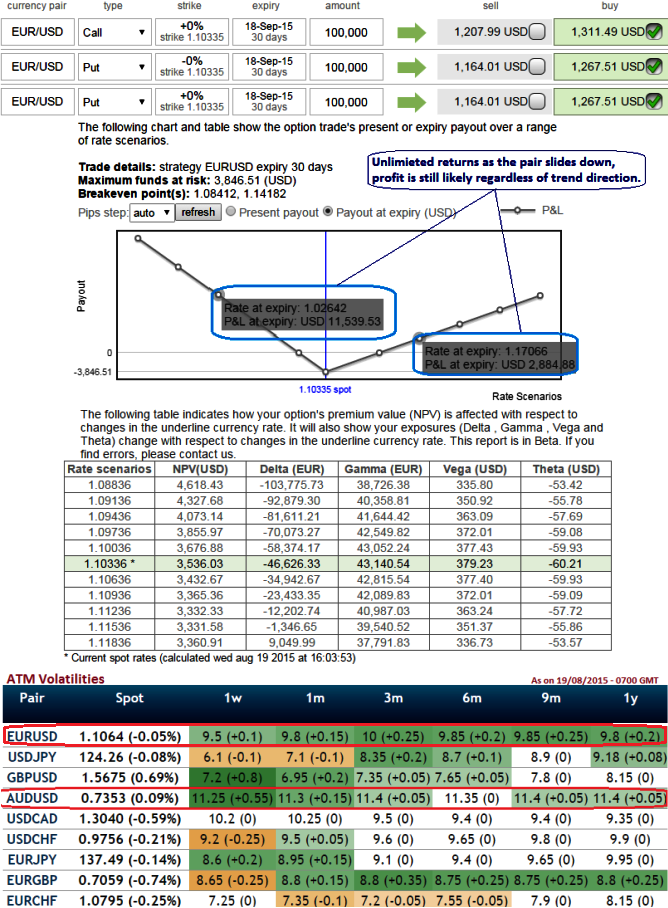

In the ATM volatility nutshell, the higher side volatility of EURUSD ATM contracts for next 3 months is projected. Although trend is puzzling on either sides the bearish momentum is likely to hold on. Huge volatility is expected over next 2-3 months.

The spot EURUSD is flashing at 1.1033 and we think the prices will make a significant move most likely in a downward direction.

As shown in the diagram, at the money calls (strike 1.1033) of 100,000 are trading at US$ 1311.41 and it is recommended buying 1 lot (size 100,000).

At the money puts (strike 1.1033) are trading at US$ 1267.51. 2 lots (same size 100,000 of each lot) are recommended. So thereby we've constructed option strip position at a cost of US$ 3846.51.

If EURUSD exchange rate at expiry would still remain at 1.1033, then the options in both legs will expire worthless and this strategy goes in vein.

But on the flip side, the pair is trading at 1.1210 which is the near term resistance by the time of expiration, then our at the money calls will be in the money and worth more premiums while the puts will expire worthless. The value of the calls will partially offset the initial investment for a total loss.

If the pair trades at expiration slightly higher than that level, then the calls will be worth even more while the puts expire worthless. The value of the calls would be greater than the initial investment and our strategy will have made profits overall.

If the pair is trading below prevailing exchange rate by the time of expiration, then the calls will expire worthless while the puts will be worth more. The value of the puts will offset the initial investment and you will break even.

By the time of expiration if the pair is trading 1.0966 levels which is our immediate strong support levels, then the calls will expire worthless while the puts will be in the money and worth more. The premiums of the puts would be greater than the initial investment and the strategy will have made net profit overall.

The combined option Greeks should be set as shown in the diagram for desirable results.

FxWirePro: 3M ATM vols signifies EUR/USD strips rather than straddle - best suitable regardless of trend

Wednesday, August 19, 2015 11:40 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand