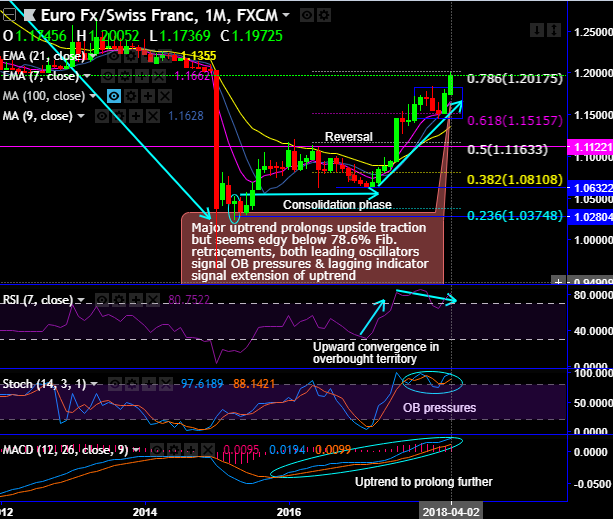

EURCHF’s major trend has retraced from the lows of 0.9651 levels to the current 1.1970 levels.

But the uptrend that was stuck in the range from last three-four months, bulls in this month have managed to break out the range on northwards but seems edgy at 78.6% Fibonacci levels, while both leading oscillators signal overbought pressures and lagging indicator signal extension of the uptrend.

Raising EURCHF forecasts by 2-3% It’s seemingly back to the future for EURCHF as the erstwhile 1.20 floor is close to being retaken after a three-year round trip. A range of factors has been cited for CHF’s accelerated drop in the last few weeks, from a repatriation of Russian funds following the imposition of U.S. sanctions – a creative but unsatisfactory explanation, in our view – to the more prosaic issue of interest rate differentials and the possibility that the incessant widening in USDCHF spreads is starting to dislodge broad-based capital flows from Switzerland even without a widening in EURCHF spreads.

Clearly, we have been surprised by this latest drop in the franc as our forecasts had expected EURCHF to be broadly stable in the mid-high teens. We are partially marking these forecasts to market now, raising EURCHF by 2-3% (the 1Y forecast is set at 1.19 from 1.15 previously).

In addition, the price action requires us to be more open-minded to the possibility that CHF’s strong balance of payments position could be overwhelmed for a longer period of time by a broader resumption of carry trade activity, especially if FX volatility continues to slide. This possibility is reflected in the risk bias to the new forecasts, which remains negative for CHF.

That being said, we don’t believe that enough fundamentally has altered to warrant flipping the CHF forecasts in an outright bearish direction. The SNB is still expected to begin to tighten policy not-too-far behind the ECB (2H’19), EURCHF rate spreads remain extremely narrow as a result, the Swiss current account surplus is extremely high, long-term capital outflows non-existent, and the franc itself now moderately cheap compared to long-term real averages. It doesn’t strike us that this constitutes a compelling basis for a major and sustained trend depreciation in CHF. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -133 levels (which is bearish). While hourly CHF spot index was inching towards -41 (bearish) while articulating (at 11:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?