The Chinese president Xi Jinping (potentially) being the biggest enemy of the U.S.? The order to U.S. companies to withdraw from China? For the financial markets, these are yesterday’s news. Instead, market participants (except for the more cautions CNY traders) focus on U.S. President Donald Trump claiming China approached the U.S. asking to continue trade negotiations. The forex market became noticeably less jumpy after that, the dollar gained and the safe-haven currencies yen and Swiss franc were able to take a little breather.

On trade talks, both China and the US keep playing tactics. Trump said yesterday on the sideline of the G7 summit that the Chinese officials called twice over the weekend, and he believed that "they (China) want to make a deal badly". However, a spokesman from China said he was not aware of any phone call recently. Hence, this is still perplexing, but according to public news reports, there supposed to be a phone call between trade negotiators this week as they agreed on the last call on 13th August. Until then, this likely to drive emerging markets apprehensive, let's wait and see what is going to happen.

On the geopolitical backdrop, EMFX volatility has under-reacted to the deterioration in global manufacturing and the attendant tightening in financial conditions YTD.

Severe undervaluation of volatility has been a persistent feature of currency markets this year that has only recently begun to respond to the worsening in the global risk backdrop after the break of 7.0 on USDCNY in early August.

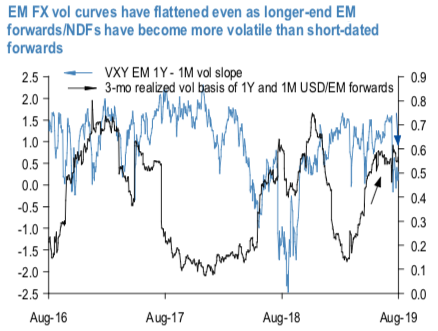

The cheapness of EM FX vol is especially pronounced in longer expiries (1Y) given the flatness of EMFX vol curves. The 1Y – 1M VXY EM vol curve is currently almost flat, which has typically not proved a sustainable state of affairs: either curves have to invert at higher vol levels amid FX stress, or markets drift into a pocket of calm that pulls the front-end lower and steepens term structures. We judge that the former is more likely in coming months, in part because of initial conditions on valuations as outlined earlier, and partly because long-end vols and vol curves have not priced in the accelerated de-coupling of US Treasury yields and the US dollar recently. While US rates and USD have been diverging all year, their moves have taken on urgency in August with the curve inversion-led cliff edge in 10Y yields (-40bp MTD) and an equally sharp coincidental surge in the greenback (JBDNUSD +1.8% MTD). USD vs. US rate de-correlation has long been recognized by options investors as bullish for vol. The intuition is that a lower UST yields lead to a mechanical widening of USD/EM (and indeed all USD/FX) forward points; longer the tenor, more pronounced this effect since forward points scale linearly in time-to-expiry. When accompanied by strength in spot USD FX, this exacerbates moves in forwards, and it is the volatility of the latter that underlies option pricing. The realized volatility differential between spot and 1Y forwards across USD/EM has climbed sharply of late and is approaching distress highs of 2016 and 2018, even as EM vol curves have flattened (refer above chart). Courtesy: JPM & Commerzbank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close