While not quite as rare as hens’ teeth, upgrades to our EURUSD forecasts have been few and far between; the last occurred as far back as February 2018. The timing then wasn’t particularly opportune - February 18 marked the start of a two-year, 15% bear market in EUR – and we trust that this won’t serve as a precedent given the material re-think of at least the levels, if not the direction, of our EURUSD forecasts this month.

On a nutshell, we are raising the projections for the next two quarters by 5% (end-2020 from 1.06 to 1.10) and the 1Y forecast by 3% from 1.06 to 1.09. The risk bias is also upgraded from bearish to neutral or less bearish.

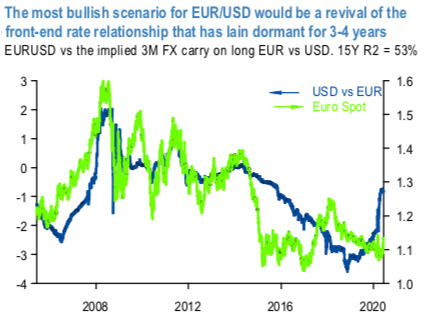

In part these forecast revisions are a mark-to-market exercise after the two-sigma bounce in EURUSD over the past month. But of course, exchange rate adjustments of such magnitudes rarely occur without a material fundamental pretext, even though technical factors such as positioning can certainly amplify the scale of the moves, as we believe they have done with EURUSD through the unwind of multi-year investor overweights in USD/underweights in EUR following the collapse in USD interest rate spreads (refer above chart).

Trade recommendations:

For all structures below, we assume no delta-hedging to be enforced. Consider:

Long 3m bullish seagull on EURUSD, long ATM EUR call / USD put, short 25-delta EUR call / USD put, short 25-delta EUR put / USD call @ EUR .36% (spot ref. 1.1330, strikes 1.1359, 1.1638, 1.1107).

Long ATM / short 25-delta 3M USD put / JPY call spread @ USD 0.66% (spot ref. 109.00, strikes 108.79/106.21) .

Long 3M USDBRL 25delta USD put / BRL call, short a 25-delta/10-delta USD call / BRL put spread @ USD 0.2% (spot ref. 5.1009, strikes 4.842/5.508/6.052). Courtesy: JPM

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?