The U.S. dollar rises on impeachment risks, so far the FX market has reacted quite calmly to the news that the US Democrats have initiated an impeachment inquiry against President Donald Trump.

While FX vols stay on side-lines while uneasy calm persists as USD correlations drop below 40% for the first time since 2016.

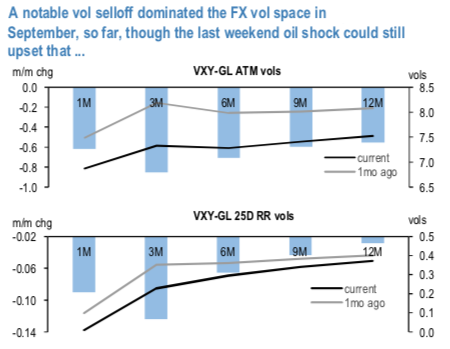

An eye-popping vol carnage dominated the FX vol space in September as risk sentiment turned around after the challenging August. The Aug spike got halved. VXY-GL term structure shifted lower (refer 1stchart) and the 3M tenor is now only 1vol above the July multiyear low with the implied – realized gap at 1.2vols still weighing on FX implied vols.

Amid the vol sell-off, delta-hedged straddles broadly succumbed (refer 2nd chart), but it is the breath of the long gamma MTD suffering that gives one a pause. Septembers seasonally tend to be one of the softest vol months and the current September proved that point. That said, the oil shock over the weekend still has potential to upset that bearish September FX vol stance even though the FX spot and vol reaction so far has been fairly contained.

Potentially a bad omen for FX vol shorts, USD correlations dropped below 40%, the first time since 2016 (refer 3rdchart). We are closely watching for signs of a mean-reversal higher which is not a question of if but of when. Such reversals have been historically associated with upticks in USD vols.

The question is whether there are still FX vol pockets where a short vol expression is plausible. Amid the overall backdrop, we are inclined to tactically and selectively harvest risk premium only in safe pockets of oil isolated EM and with the longevity of such short vol stance highly uncertain we prefer limited downside structures, as discussed below. Courtesy: JPM

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different