USD and JPY skews have tightened rather drastically as of late. While in the case of EURUSD the gradual tightening and later flip in sign of the riskies was associated to investment flows in the Euro-area (The euro’s bullish flow gorilla now weighs in at a hefty EUR 620bn), and for cable to sustained flows in GBP topside structures, when the yen is no longer a safe-haven currency, according to the recent J.P. Morgan research) pointed to the reduced Yen safe-haven status, as repatriation of foreign investments from locals reduced, even in risk-off markets, an effect which put pressure on JPY-skews.

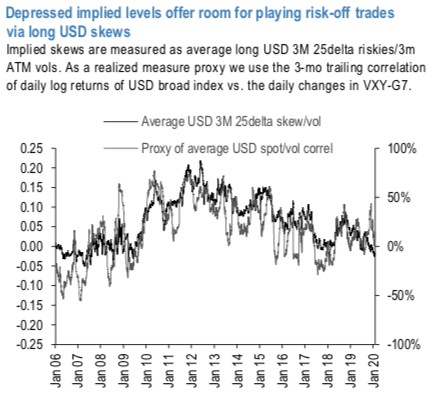

We try to assess whether the latest repricing of USD and JPY skews is actually consistent with a reduced expectation of these currencies to rally in a risk-off market (refer 1st diagram).

In the chart, we show an average of G10 USD and JPY skews (3m, 25delta), scaled by the corresponding 3M ATM vol, as a proxy of the implied price for playing the skew trade. As a realized measure, we look at the 3M correlation (daily log returns) between USD and JPY indices and the J.P. Morgan G7 VXY Index.

In both cases, we see that the two measures track each other very closely over time, and that the reduced sensitivity to risk for both currencies motivated the drop of skew implied levels.

However, by looking at the most recent dynamics, we can see how the drop of the average USD skew into negative territory offers a cheap entry point from a spot/correlation angle, on the back of a still positive exposure to risk of the long USD position. In other words, risk-off trades via long USD-positions offer a discount thanks to the attractive entry point on the skews.

By considering the benign pricing of vol levels, and the attractive entry point thanks to the depressed skews on the pricing of long USD trades via OTM options, we look for an extra correlation discount for playing a risk-off Asian market, in case where the Coronavirus epidemics were to spread (and scare the markets) further. Coronavirus hedges had been already the subject of a couple of FX vol pieces last week, hedging Coronavirus outbreak with FX options is not difficult given low vol. Similarly as for skews, USD correlations currently appear near the historical turning point (refer top chart in the 2nd diagram), could exhibit a 10-15pts correction and only modestly overstretched vis-a-vis trailing realized corrs.

There is only 5 corr points premium between 3M implied and 3-mo trailing realized measures. For the SGD, KRW, INR triplet (refer bottom chart in the 2nd diagram), the 3M USD implied correlations show lack of almost any correlation premium which is at odds with the Monday spot FX price action, i.e. a virus-driven cohesive drop of regional currencies against the dollar.

Long USD skews and correlations, therefore, offer a cheap entry point for hedging the emergence of the Coronavirus as a global epidemics and a factor capable of upsetting the risk-loving narrative markets had enjoyed since end of last year. Rather than expressing the hedges as pure vol plays, some of which have been already discussed, we prefer considering two low-premium / high-payout structures that benefit from current market parameters. This tactically guides in favoring short-dated Expiries (1M).

Consider: 1M At-Expiry-Digital (USDINR >2% OTMS; USDKRW >2% OTMS; USDSGD >2% OTMS) call @ 2.8/4.8% indicative.

1M ATMS worst-of basket USD ATM call on (USDINR, USDKRW, USDSGD) @ 0.225/0.275% indicative. Courtesy: JPM

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges