The Brexit negotiations continue to be a constant toing and froing. It is quite surprising that Sterling reacted so little to these developments until recently. By now, it is found out to be easy to understand, as every time London and Brussels seem to be getting a little closer to agreeing on something the next setback is only around the corner – and the other way round. It is simply frustrating to trade Sterling in the face of such a volatile news flow, particularly as this has been going on for months now.

Yesterday it was less the news that the hard-line Brexiteers within the Conservative Party would try to topple Prime Minister Theresa May that put pressure on Sterling in my view. It should really be clear that they will not be able to find a majority against May in Parliament. What was much more worrying was the news that the Brexiteers wanted to initiate legislation over the next couple of days that would make the back- stop for the Irish border which the EU is proposing illegal.

They apparently even have the support of the Northern Irish DUP, the Conservatives quasi coalition partner, on the matter. The risk is that the Brexiteers would get entrenched even deeper in their position which would make the negotiations much more difficult.

Conclusively, a solution on the Irish border is only possible if one of the parties involved – i.e. the EU27, the Brexiteers or the DUP – gives in; but clearly no one is prepared to do so at present.

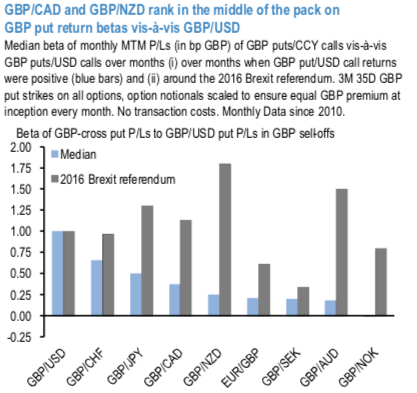

GBP/commodity FX risk-reversals are far more benignly priced for Brexit risks relative to the punchy pricing of GBPUSD riskies. GBPNZD and GBPCAD puts also have track record of delivering decent P/Ls during previous sharp GBP sell-offs.

Onto other crosses. The above chart exhibits monthly return betas of GBP put options across G10 vis-à-vis those of GBP puts/USD calls over two sub-samples:

1) All months when GBPUSD put returns were positive, and

2) May-June of 2016 around the Brexit referendum. As anticipated, GBPCHF and GBPJPY have the highest median betas to GBPUSD (and even then, less than 1); GBPCAD and GBPNZD are interesting mid-table entries that rank ahead of even a liquid GBP-cross such as EURGBP. The even more noteworthy numbers are the return betas around the Brexit referendum event: GBPNZD, GBPAUD and to a lesser extent GBPCAD puts were the standout performers on that occasion, in part because GBP-weakness remained a localized event without broader risk market spill-overs, and partly due to benign option pricing, ostensibly for similar reasons that their riskies are subdued today. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -98 (which is bearish), while hourly CAD spot index was at -41 (bearish) and USD at 131 (bullish), while articulating at 11:32 GMT. For more details on the index, please refer below weblink:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data