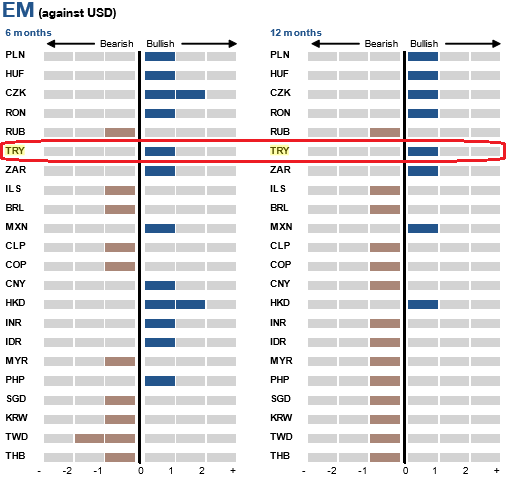

EM currencies rely more on carry for returns. But valuations aren’t yet demanding and the growth backdrop offsets gradual Fed rate hikes. The PLN and CZK are our picks among low-vol EM currencies, and we think the MXN, TRY and ZAR look cheap.

In the above chart, we calculate total return expectations vs USD by comparing our 3M and 12M currency forecasts to the forward rate and normalize these expected returns by the respective implied volatilities. The charts classify the results according to sign and absolute value (below 1.0, between 1.0 and 2.0 and above 2.0).

We are more worried about the recent rise in US real yields, which motivates our selective hedges (e.g. TRY). A few research analysts in the past have emphasized the distinction between increases in core yields driven by rising breakeven inflation (good bond sell-off) versus rising real yields (bad bond sell-off). For high yielding FX, higher real yields are associated with asset price weakness, and higher breakeven inflation with asset price strength (refer 2nd chart).

However, the equity sell-off has to some extent halted the rise in real yields and also a significant move higher in real yields is unlikely to be sustained without tangible evidence that the Fed's thinking is also consistent with higher terminal real rates. As such we position for this risk only with selective hedges in the most vulnerable currencies (e.g. TRY).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation