Achieve more value in owning carry than shorting vols in EM: The paucity of opportunities to play vol compression is a boon for carry-friendly option bets in anticipation of a risk rally next week in the absence of an election upset.

EM currencies that are likely to be the target of the scramble for risk-on plays already boast of carry/vol ratios that are near 2-yr highs (refer above chart) and likely to climb even further once vols normalize, so option pricing is better than opportune to position for moderate appreciation.

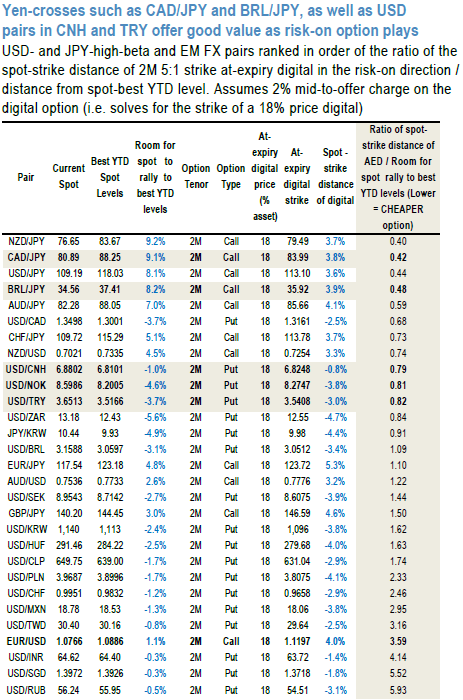

We reckon that the risk rally will be broad enough to lift all boats, but for selective alpha hunters, the table above presents a rough-and-dirty framework for differentiating value across currencies. The starting point of the exercise is that relatively low vega instruments such as call spreads rather than outright calls should be the weapons of choice to play risk-on given the likely compression of vols in such an environment, and that at-expiry digital options can be used as a handy stand-ins for vanilla spreads due to their analytic simplicity of a single strike.

Far harder is to handicap the extent to which various currency pairs can rally; we make the simplifying assumption that best YTD spot levels represent the maximum potential for the bullish retracement.

The ratio of the spot-to-strike distance of fixed price digital options (the above table solves for strikes of 2M 5:1 levered instruments) to the maximum retracement room for spot (last column in the table) can then be used as a simple value metric: smaller the ratio, lower the heavy lifting required of spot to deliver maximum payouts on options. The obvious drawback of the approach is that it unfairly penalizes currencies with one-way appreciation trends this year (USDINR, USDMXN, USDRUB) that do not possess much value/retracement room.

Despite this weakness, a couple of observations are worth making:

Yen-crosses offer better value than USD pairs despite their higher vols simply given the scope for USD/JPY to reverse some of its recent declines.

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads (USDCAD spike disproportionate to underlying drivers).

BRLJPY also appeals as a higher-beta expression of real strength which is a favored fundamental overweight inputs/KRW calls strike us as better bets than USD puts/KRW calls for investors not averse to fading geopolitical risk premium in the won.

USDCNH and USDTRY screen as the cheapest EM appreciation plays. Within G10, petro-currencies such as USDCAD (CADJPY is a better expression in our view) and particularly USDNOK – simultaneously an EURUSD correlate and a laggard vis-à-vis oil – are the top picks outside of the antipodean FX complex that has long been a structural underweight for us.

Finally, EURUSD stacks up at the bottom of the list largely because of richer-than-average vols, but also because the potential for appreciation towards the year’s highs ~ 1.09 is too limited to justify paying current lofty option premia. Yet another reason to favor NOK over EUR on RV grounds.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts