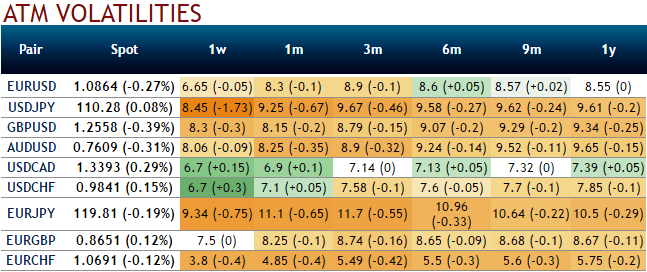

Please be noted that the nutshell showing IVs of G7 pairs have collapsed considerably. The collapse in vols following in the recent times FOMC’s dovish statement, even in longer tenors less influenced by event-related day-weights, says all one needs to know about the option market’s view of Fed policy. The Goldilocks-like risk environment it seems to have ushered in may well keep the broad dollar in a range over coming months, trapped between a soft cap enforced by Fed gradualism that incentivizes investor flight away from quality, and a soft floor from the USD TWI’s already material underpricing vis-à-vis interest rate differentials and the ever-present prospect of US fiscal/trade shocks.

Coupled with the anti-populist outcome of the Dutch elections, we suspect this will unshackle investors who have hitherto been hesitant to enthusiastically embrace the reflation rally, and put even greater pressure on vols over the next 2-3 weeks.

Gamma vols are already extremely depressed after edging lower since the turn of the year, hence incremental vol selling interest should migrate out to longer expiries along curves that look extremely steep in a historical context (refer above chart).

We think the most vulnerable back-end vols are 1Y –18M expiries in EM currencies where curves are steep (refer above chart) and are either already fundamentally embraced by investors (BRL, RUB) or where a mix of lingering underweight positions and high beta to global equities holds out promise of sizeable inflows (KRW, ZAR). In addition to a more sanguine Fed outlook, a second factor that has weighed on vols recently is that day-weights for French elections have compressed sharply over the three weeks.

EUR/G10 forward vols spanning both rounds of the election have fallen 3.8 % pts. on average (refer above chart), with the biggest declines concentrated in the most event sensitive pairs such as EURCHF and EURJPY (refer above chart). This is reasonable since the odds of a Macron victory have risen in recent days.

Polls on the first round of the French election are showing a solid lead for Le Pen and Macron over the rest of the field, with Macron now catching up to Le Pen; the second round Macron –Le Pen spread remains solidly 20%+ in favor of the former.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says