US Treasury yields moved 3-6bp higher over the first half of the week, as domestic producer prices and import prices came in higher than expectations, and the May refunding auctions all tailed amid weakening in end-user demand (refer above nutshell).

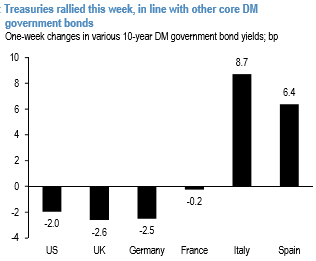

However, this more than fully reversed following Friday’s benign April CPI reading. Since our last publication, front-end and intermediate Treasury yields declined 1-4bp, and the US broadly outperformed other DM government bond markets (refer histogram chart).

But still, with the unemployment rate sitting at its lowest levels of the expansion, matching the 2006 lows, and below the Fed’s year-end and longer-run projections, we continue to expect that the tightness of labor markets will drive the Committee to raise rates by 25bp at the next policy meeting on June 13-14.

Certainly, OIS markets are pricing approximately two thirds odds the Fed will raise rates next month, suggesting limited room for very front-end rates to move higher over the near term, but cyclical dynamics suggest intermediate yields can rise over the next few weeks ahead of the FOMC meeting. The yields have consistently risen ahead of FOMC meetings which are accompanied by an SEP and a press conference.

The third ogive chart shows that over the past two years, 5-year Treasury yields have risen by an average 5bp in the month leading up to long-form FOMC meetings, and this has occurred prior to 7 of the last 8 meetings.

We are bullish on the Ultra 10-year (UXY) contract weighted calendar spread. Wildcard optionality is modest while asset managers are net short. Furthermore, this contract has consistently richened into the first notice date since its inception.

We are bearish on the 10-year note (TY) contract weighted calendar spread. Asset managers and central banks are again net long, whose positions have proven a reliable driver of price action through the roll. Beyond this, the calendar roll has exhibited a strong cyclical tendency to narrow into the first delivery date.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal