A glimpse over macros:

Despite signs of a reversal, the JPY outperformance trend over the past few weeks has been more resilient than expected. For EURJPY, this has resulted in a break of key support levels and a more protracted corrective phase especially with the most focused on the political event in Euro area in the near future — the French elections is now exactly a month away. The forecast assumes that mainstream parties prevail, which combined with a less dovish ECB should eventually result in EUR strength.

In turn, a continuation of the outperformance trend can persist for the short term timeframe. Despite this framework, the risk of a bearish shift for JPY in the coming months is unchanged.

OTC outlook:

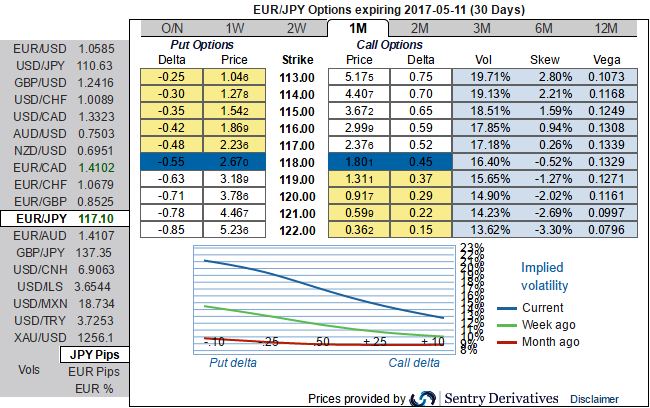

Please be noted that the nutshell showing risk reversals and implied vols of ATM contracts signify the mounting hedging sentiments of EURJPY’s bearish risks.

1w1m combinations serve conducive environment of options writers and holders of put spreads.

While positively skewed IVs of 1m tenors also signify the hedgers' interests in OTM put strikes that imply underlying spot likely to head southward targets.

Trade recommendations:

EUR/JPY demonstrates the highest beta to Euro-turmoil for the obvious reason that both legs of the cross pull in the same direction during stress. The GFC period is deliberately excluded from the analysis assuming that a global shock on that scale is unlikely to be repeated; its inclusion does not alter currency rankings but does amplify the magnitudes of elasticities in both directions.

Buy 6M at the money EURJPY -0.49 delta puts.

Alternatively, one can also think of buying 1w1m debit put spreads of strikes 119.7509/114.75.

Risk-averse traders, stay long in CADJPY vs. sell EURJPY 1M ATM straddles, vega-neutral.

Sell 6M vs buy 1Y EURJPY 111 One-Touch puts, 0.758:1 notionals.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation