The yield of 10-year US Treasuries flirted with the 3% mark again yesterday and immediately all the usual suspects (BRL, MXN, RUB, INR, ZAR and TRY) came under depreciation pressure again.

However, a part of the recent depreciation of EM currencies is also likely to be due to the excessive optimism is seen over the past few months: in view of a lack of other alternatives, EM investments were in high demand. A strong rise in US yields still bears the risk of triggering a far-reaching round of EM depreciation.

However, as EM current account deficits are much lower - compared with the crisis in 2013 - and in view of the much more stability-orientated EM central bank policies, we are confident that this remains a risk scenario.

The question around the longevity of the ongoing USD rally remains. The base case YE scenario is for a 1.5% narrowly bearish USD path to YE.

Admittedly, IMM positioning indicates the USD shorts at around USD26bn (more than 2 sigmas below 1-year average) to be the widest since Aug 2011, posing a notable risk from unwinds (part of which likely already played out in the recent 1.9% USD TWI move). Absent a high conviction into a sustained USD rally we opt for looking for short tenor, cheap, leveraged USD hedges.

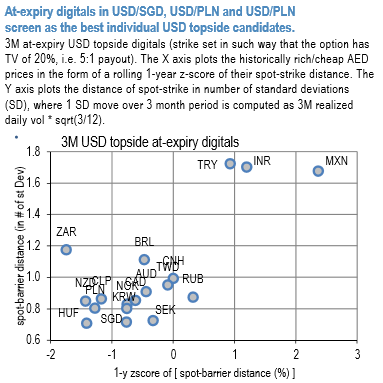

1st chart (RHS) compares individual short tenor USD topside at-expiry digitals across EM and high beta G10. SGD, HUF, PLN, KRW and NZD screen as the best value based on the current spot-barrier distance (all strikes are set in such way that the digitals price at 20%, i.e. project 5:1 payout).

Over the past week, the USD already strengthened against all five, the most so against NZD and PLN, 3% and 2% respectively. 2M 1.3500 strike USDSGD AED call costs 19.5% (after 3% stealth) spot ref 1.3254. USDSGD was at 1.3500last Dec before the dollar slump.

Considering that if the USD bounce resumes it is likely to be broad-based, mimicking the price action from the last few days, and to gain leverage we turn to a basket approach. Baskets aim to benefit from implied correlations that are in the middle of the historical 40-60% range and still having room to reprice higher – a process that has already started.

In the 2nd chart, it displays some of the more attractively priced 2M worst-of basket USD/high beta ATMS calls that offer solid correlation savings (50% vis-à-vis cheaper vanilla, after accounting for a 20bp USD transaction cost charge). Combinations involving SGD and TWD appear the most frequently. CLP and CAD are the other two prevalent currencies.

These low-cost instruments are worth considering as leveraged hedges against a protracted broad-based USD move or to lever up vanilla or cash positions. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand