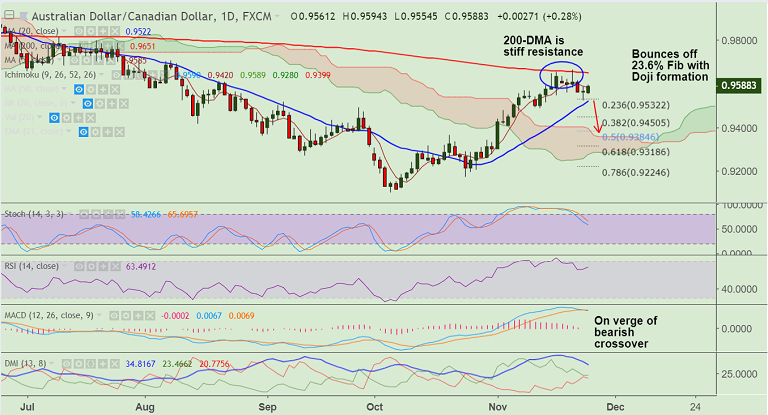

AUD/CAD chart on Trading View used for analysis

- AUD/CAD is trading 0.20% higher on the day at 0.9586 at the time of writing.

- The pair has bounced off 23.6% Fib support on Friday's trade and has edged above 5-DMA.

- We see a Doji formation at 23.6% Fib support which raises scope for further upside.

- The pair is in a near-term bull trend and breakout at 200-DMA could see further upside.

- On the flipside, 20-DMA is strong support and break below will see further weakness.

- Focus now on Australia Capex data for further impetus. Markets expect a +1.0% q/q rise for Australia’s Q3 real private capital expenditure (capex).

Support levels - 0.9532 (23.6% Fib), 0.9522 (20-DMA), 0.9450 (38.2% Fib)

Resistance levels - 0.9651 (200-DMA), 0.9664 (Nov 21 high), 0.97

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data