It is now BoJ's turn that keeps the policy status unchanged after Fed. The BoJ decisively has been firm by an 8 to 1 vote to leave the bank's policy target unchanged, as largely expected, indicating policymakers are confident that the economy will likely to rebound in the near future.

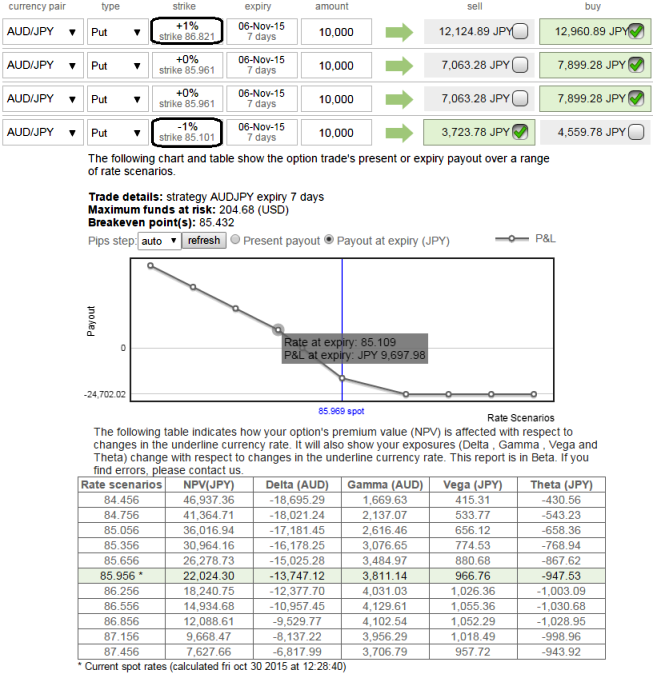

So far we all know that the position uses long and short puts in the ratio of 2:1, now alter it into 3:2 so as to maximize the returns as we could sense the more downside potential but again it depends upon risk appetite and returns expectations.

The implied volatility of 1M ATM AUDJPY put contract has nothing much changed, it is almost close to 14% which is quite on higher side that is good sign for option writers.

We know that the options with a higher IV cost more, intuitively due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Hence, as shown in the diagram weights have been doubled and resulted into huge cash inflows for every small change in underlying exchange rate.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 2 lots of At-The-Money -0.52 delta puts, 1 lot of OTM put and simultaneously short 1W 2 lots of (1%) In-The-Money put option.

Entering into this AUDJPY position which has higher implied volatility at 14% and expecting for the inevitable adjustment is a smart approach, regardless of the direction of price movement.

Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: AUD/JPY ATM IV still favors put writers – 3:2 PRBS to extract max leverage

Friday, October 30, 2015 7:30 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings