The two main risks to our bearish AUD view are that

1) The currency is dragged higher in a more sustained re-rating of the global growth outlook, and that

2) The better global news and some signs of housing resilience see the RBA play for time.

Hence, we remain of the view that the RBA would ease a further 50 bps in this cycle.

On the flip side, The BoJ would meet on January 30-31st. While we expect inaction of the BoJ until Kuroda’s term ends in April and the Japanese central bank accelerates debt monetization and Japan’s inflation expectations materially rise.

Short AUDJPY through a one-touch calendar spread We structured a bearish AUDJPY view through a calendar spread of one-touches (short a 3m one-touch put, long a 6m) to capture the good-bad duality in Trump's policy platform. In nutshell, buy a 6m 78.0 AUDJPY one-touch put, sell a 3m in premium-rebate notional.

The markets have been squarely focussed since the election on a pro-risk loosening in fiscal policy and corporate deregulation, but the positive impact on risk sentiment and cyclical crosses such as AUDJPY could yet be reversed should the new Administration deliver on its protectionist agenda, as Trump’s choice of personnel to oversee trade very much suggests it intends to do.

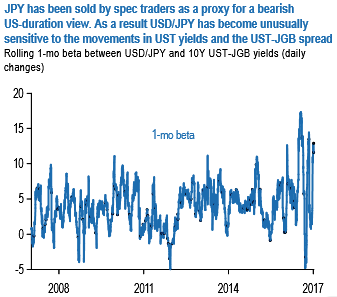

Aside from the trade issue, the yen remains highly sensitive to US yields (the beta of USDJPY to UST yields is the highest in a decade – refer 1st chart), not so much because Japanese investors are taking advantage of higher yields (they have divested out of foreign bonds since the US election – refer 2nd chart), more that short-term traders regard USDJPY as an effective proxy for a short US duration view given the BoJ’s cap on JGB yields.

Speculative participation in the yen sell-off is consequently high (IMM shorts are the largest since summer 2015), but so too the risk of a deeper squeeze on positions should there be any trade action from Trump from day one. CNH shenanigans may also curb the market’s enthusiasm to hold large JPY shorts.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?