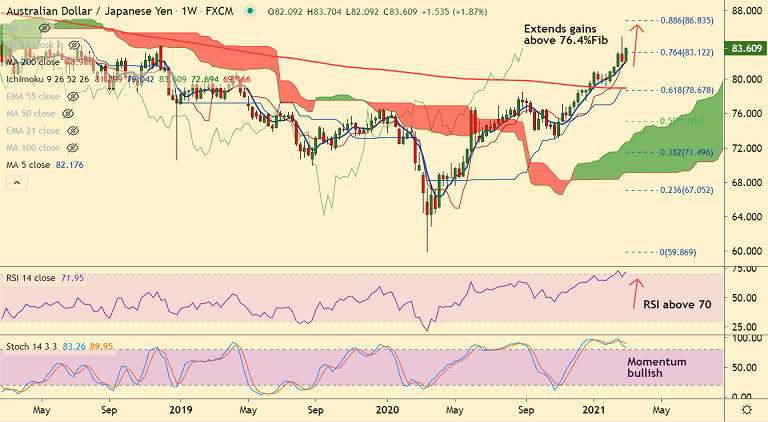

AUD/JPY chart - Trading View

AUD/JPY was trading 0.26% higher on the day at 83.59 at around 05:20 GMT, extending previous session's 0.51% gains.

Australian dollar buoyed following better-than-forecast Aussie Q4 GDP data and improved market sentiment.

Australia's economy expanded 3.1% quarter-on-quarter in Q4, beating the estimated drop to 2.5% from 3.4% in Q3. In annualized terms, the economy contracted 1.1% versus -1.8% expected and -3.8% previous.

Aussie bulls unfazed by dismal Chinese Caixin Services PMI which fell to 51.5 in February from 52 in January.

Risk recovers as US President Joe Biden’s vaccine optimism joins hopes of a rate cut from the Chinese central bank, favouring bulls.

AUD/JPY has erased most of previous week's losses and is currently trading above 76.4% Fib. Price action is consolidating above 110-month EMA.

Momentum is bullish, volatility is rising, bulls likely to retest 200-month MA at 84.66. Decisive break above will propel the pair higher.