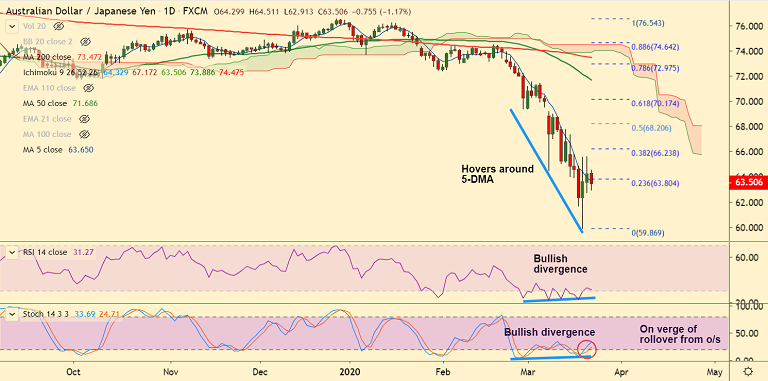

AUD/JPY chart - Trading View

AUD/JPY hovers around 5-DMA, pauses 2 straight sessions of upside, bias turning neutral.

The pair was trading 1.09% lower on the day at 63.50 at around 07:00 GMT after closing 1.06% higher on Friday's trade.

Major trend in the pair is bearish, but a 'bullish divergence' and 'oversold oscillators' hold scope for upside.

Australia's government on Monday announced a second major economic rescue package worth $66 billion, on top of an initial $17.6 billion package.

The pair largely unimpressed. Risk aversion continues to drive markets, weighs on the upside.

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Bearish Oversold

Support levels - 62.706 (Hourly cloud), 59.869 (Mar 19 low)

Resistance levels - 65.175 (200H MA), 66.238 (38.2% Fib)

Summary: Major trend is bearish, but 'bullish divergence' and 'oversold oscillators' hold scope for minor upside. Watch out for break above 200H MA for further gains.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand