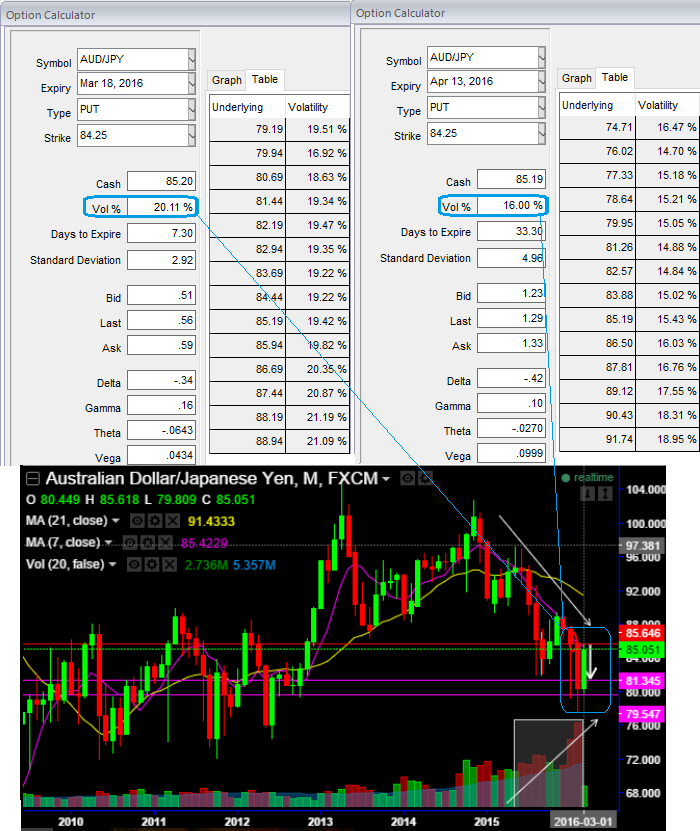

This pair has been oscillating between 85.645 and 84 levels as buying momentum is reduced but long term trend seems to be intact as you can see the convincing volumes and technical indicators favouring bears on monthly charts.

While IVs of ATM contracts of 1w and 1m tenors are spiking crazily and this has been justified by historical volatilities in spot FX fluctuations (see big real body candles on monthly technical charts).

ATM IVs of 1w expiries are flashing at 20.11% and 16% for 1m tenor.

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 16% and it is quite higher side when long term trend is bearish and spikes in previous rallies for short term which is good sign for option writers.

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations.

Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: AUD/JPY swings move in sync with 1M ATM IVs - rallies and HY vols likely to favour PRBS

Friday, March 11, 2016 6:51 AM UTC

Editor's Picks

- Market Data

Most Popular

2