- Aussie dented after China Caixin manufacturing PMI dipped into contraction territory in May, widely missing forecasts.

- China's Caixin manufacturing PMI for May arrived at 49.6 vs 50.1 expected and 50.3 last, slipping into contraction on slower increases in output and new orders.

- Traders brush aside upbeat Australia retails sales data which rebounded 1% in April, which is way above the consensus estimate of 0.3%.

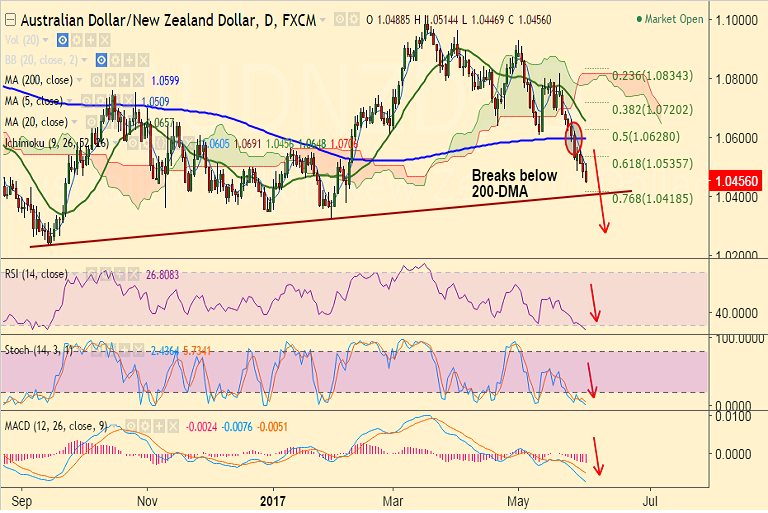

- AUD/NZD has broken below 200-DMA and price action well below daily cloud, pair on track to test 1.04 levels.

- Technical studies are highly bearish, but RSI and Stochs at oversold levels, so some caution advised.

- We see bearish invalidation only above 200-DMA at 1.0599 levels.

Support levels - 1.0418 (76.8% Fib), 1.040 (trendline)

Resistance levels - 1.0540 (5-DMA), 1.0599 (200-DMA), 1.0674 (20-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-NZD-slumps-to-fresh-multi-week-lows-bias-lower-test-of-104-likely-733677) has hit TP1.

Recommendation: Stay short for 1.04 levels.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -30.9158 (Neutral), while Hourly NZD Spot Index was at -1.36697 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.