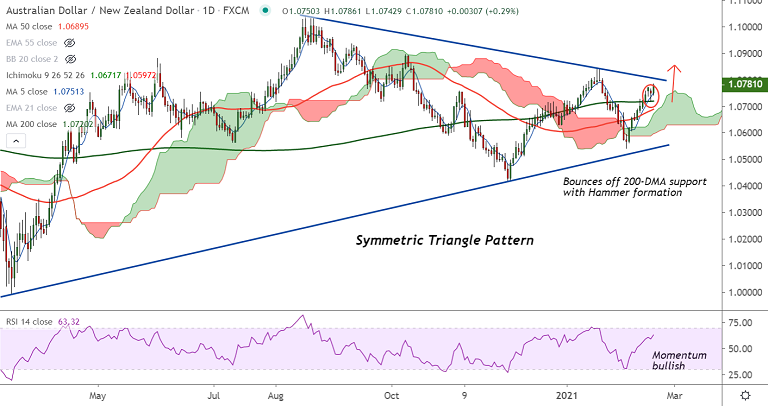

AUD/NZD chart - Trading View

Technical Analysis: Bias Bullish

- AUD/NZD trades 0.27% higher on the day at 1.0779 at around 10:00 GMT

- Pullback has bounced off support at 200-DMA (1.0719), weakness only on break below

- Hammer formation on Tuesday's candle suggests buying pressure at lows

- RSI and Stochs are bias higher, RSI is above 60 mark which shows strength in the uptrend

- Price action has edged above 55 month EMA at 1.0738, close above will open upside

- Analysis of GMMA indicator shows major trend is neutral and minor trend is bullish

- Scope for test of 1.08 mark. Breakout above Symmetric Triangle pattern will fuel further gains

Support levels - 1.0751 (5-DMA), 1.0738 (55 month EMA), 1.0720 (200-DMA), 1.0705 (21-EMA), 1.0686 (110-EMA)

Resistance levels - 1.08 (Trendline), 1.0843 (2021 high), 1.0895 (Oct 8th 2020 high), 1.0968 (110 month EMA)

Summary: Major trend in the pair is neutral, decisive break above stiff resistance is seen at 55 month EMA at 1.0738 will change near-term dynamics. Scope then for test of 1.08/ 1.0840/ 1.09.