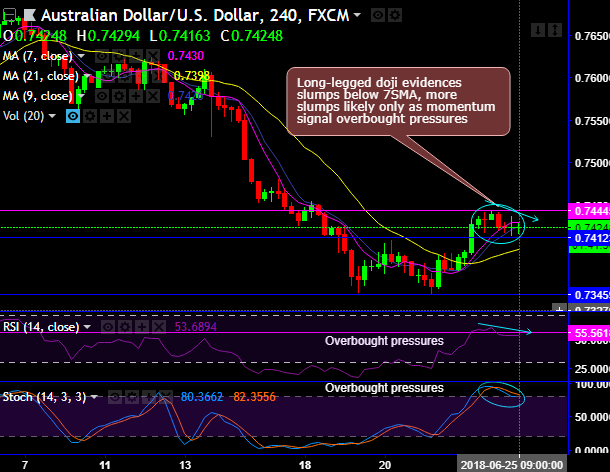

AUDUSD forms long-legged doji at 0.7433 and 0.7423 levels that evidence the slumps below 7SMA again, both RSI and stochastic curves have hampered previous bullish momentum.

While on weekly terms, it has formed dragonfly doji pattern at 0.7440 levels but the bullsih pattern candle is unable to produce any considerable rallies as both leading and lagging oscillators are on bearish favour.

For now, more slumps seem to be on cards as momentum oscillators signal overbought pressures (refer daily chart). Following a 3 cent decline this month, a rebound to 0.7500 is possible if global risk sentiment remains supportive.

The medium term perspectives: The Aussie has been one of the worst performers in the broad-based US dollar rally since the June FOMC and ECB meetings.

It is now below our weekly fair value estimate for the first time this year. If US-China trade tensions remain the market focus in coming weeks, risks are to 0.72/0.73.

But Australia’s key commodity prices have been broadly resilient, especially LNG and thermal coal, suggesting AUD downside should be contained multi-month. The RBA should also be optimistic on Australia’s growth outlook in its Aug statement. We look for 0.75 end-Sep.

On a broader perspective, the pair has been going through consolidation phase after a massive downtrend, bears have managed to break-out uptrend-line support, the major trend goes non-directional (refer monthly plotting).

Trade tips: Well, on trading perspective, at spot reference: 0.7428 levels, it is advisable to tunnel spreads using upper strikes at 0.7444 and lower strikes at 0.7412 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping below but remains within these strikes on or before the binary expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 0.72 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 26 levels (which is mildly bullish), while hourly USD spot index was at -68 (bearish) while articulating (at 11:54 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: