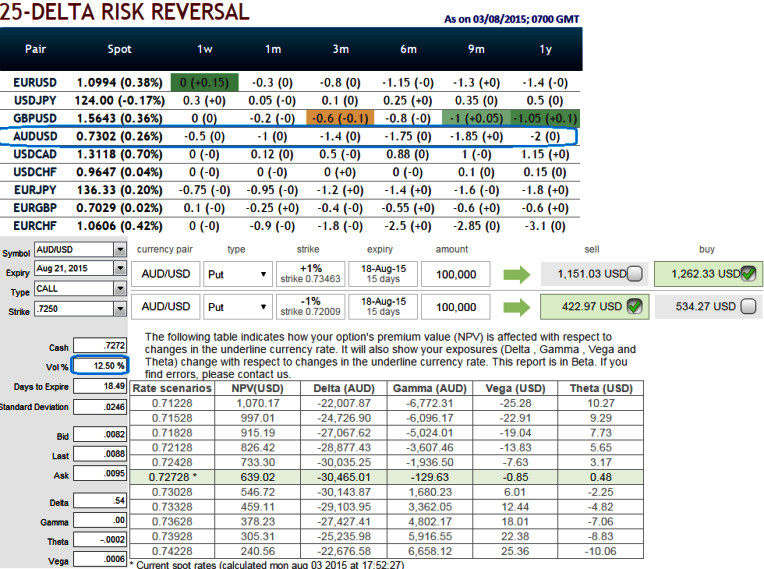

Rationale: Prevailing implied volatility rates for AUD/USD ATM 1M-6M contracts are in range of 12% to 14%. But higher negative delta risk reversal indicates put contracts have been relatively costlier. In the nutshell, AUD/USD Out of the money options are trading with negative delta risk reversal which would mean that downside risk protection is more expensive.

The downside risk in AUD against USD is anticipated as the Fed's rate decision seems to be is in line with the Yellen's hints after she sent strong indications that US economic conditions are likely to justify an interest rate hike at some point this year. But Aussie import prices QoQ are improved by 1.4% which is in line with forecasts.

For Australian exporters who have their receivable exposures in AUD, we advocate gamma spreads rather than naked puts (even OTM puts have been expensive). As the risk appetite varies from different investors to different traders, we've customized our formulation of strategies for such varied circumstances.

When the above naked put option was highly sensitive to the underlying exchange rate of AUD/USD, we think it adds to the risk and reward profile for both options holders and writers. So, buy 15D (1%) In-The-Money 0.15 gamma put option and short 15D (-1%) Out-Of-The-Money put option for net debit.

FxWirePro: AUD/USD delta risk-reversal signifies overpriced puts; HY gamma spreads for IV riddle

Monday, August 3, 2015 12:30 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?