FX option strategy: Long Straddles (AUD/USD)

With a view of non-directional trend is anticipated in medium term backed by RBAs lackluster comments on exchange rate, we recommend this currency option strategy.

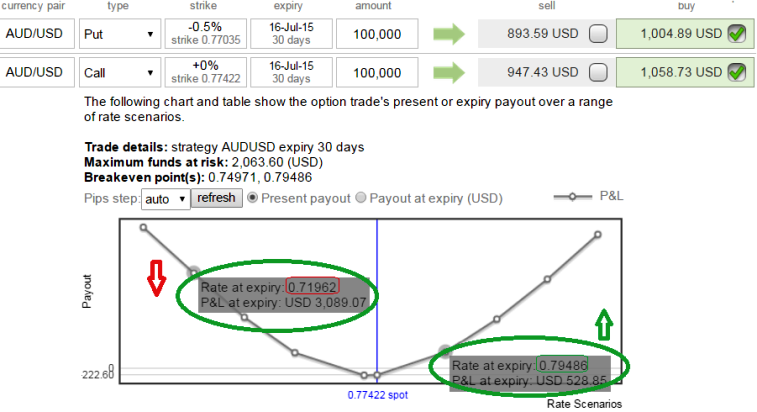

Buy 30D At-The-Money delta 0.48 call (strike at 0.7740) and buy 30D slightly Out-Of-The-Money -0.45 delta put (-0.5% strike at 0.7703).

We kept slight out-of-the money on put option so as to make combined delta in positive zone as we are not writing options.

As shown in the diagrammatic representation of this strategy, in order to construct this strategy this options straddle is trading at 12.36% premium when compared with NPV which we reckon this as a good buy to hedge unanticipated dramatic fluctuation in AUD/USD rates.

We could foresee 0.7792 as upside targets & 0.7625 on dips, which means 80 pips on upside and 120 pips on downside from current levels.

You can figure out from the chart, irrespective exchange rates moves on either side how beautifully our straddle construction is deriving profits on lot size 100,000 units.

Computation & interpretation of delta on single side of this strategy is the most essential criteria while choosing option instruments.

FxWirePro: AUD/USD straddle likely to fetch assured gains around 200 pips

Tuesday, June 16, 2015 12:02 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?