Selling EURGBP vs EURJPY correlation swaps to exploit idiosyncratic GBP noise with positive carry.

Short EURGBP vs. EURJPY correlation in our view, the re-emergence of idiosyncratic UK policy risk as a GBP driver is a catalyst for de-coupling of EURGBP from other EUR-crosses in the weeks ahead.

The macro team notes that the collapse in the correlation between EURGBP and EURUSD, for instance, can be rationalized in part by the flip-flopping in monetary policy guidance from BoE as the data cycle has turned, partly by the long shadow cast by Brexit negotiations, and to some extent by a series of large M&A transactions.

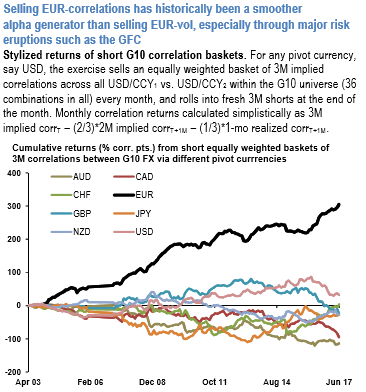

The rest of Euro-bloc FX is likely subject to more systemic forces of ongoing dollar strength and/or renewed emphasis on European political risk (c.f. Italy), hence short correlation plays between EURGBP and other EUR-crosses can be a useful source of alpha, especially in the context of meaningful systematic returns from selling the broad universe of EUR-denominated corrs – refer 1st chart which is reproduced from a previous publication on the issue.

Within the Euro-bloc, EURGBP vs EURJPY correlations screen as the most compelling short at present. Current implied corrs 20 is nothing to write home about in a historical context but are a healthy 20-30 % pts. too high vis-à-vis trailing realized corrs (refer 2nd chart).

Additionally, if the ongoing weakness in EM intensifies, it is comforting to know that historical asymmetry is in favor of correlation sellers: EURGBP – EURJPY implied corrs have fallen by 12 % pts. on average across sizeable vol shock events over the past 15-yrs, without unpleasant tails even during the years of the EU debt-crisis fuelled broad Euro sell-offs.

We open a short 3M corr swap as a positive carry, vol spike resilient construct to monetize idiosyncratic GBP noise. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -88 levels (which is bearish), while GBP flashing at -97 (bearish), and hourly JPY spot index was at 71 (bullish) while articulating at (11:04 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook