Over the weekend, the price of precious yellow metal has taken a halt from the vigorous rallies at the peaks of $1,738 levels but still travelling northwards that is on the verge of multi-years’ highs.

Currently, XAUUSD is trading at $1,722 levels which is just $74 away from 8-years. Gold, for the first time ever, punched through the R1m a kilogram price level. Though trading below its 2012 peak of $1,772.25 an ounce in dollar terms, the stiff resistance is observed at $1,750 areas. Gold (in the bullion market) gains considerably from the last couple of days, especially after testing the strong support at $1,445 - $1,455 levels).

Since March 19 when the front-end gold vols peaked the normalization has flattened the vol curve and halved the March vol spike.

While not drastically bullish gold price should be firmer from here as once/when equity volatility calms they anticipate relationship with real yields to re-assert itself.

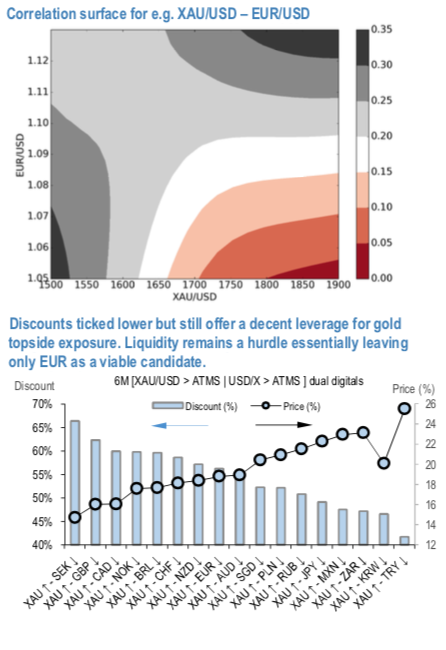

Back in March we discussed workings of an interplay between correlations and risk reversals (RV opportunities in the implied correlation vs. riskies space, according to JP Morgan’s fundamental analysts). Namely, we discuss that correlation surfaces display a marked strike-sensitivity (i.e., they do depend on the skew). On the occasions where the pricing of the two USD riskies is opposite (as is the case for e.g. XAUUSD and EURUSD or CADUSD) and the implied correlation is positive, there is an apparent mismatch as far as directionality of risk is concerned between riskies and correls. When finding such RV mismatches, one could conclude that either the price of riskies or that of correls presents an opportunity.

As discussed in the above note, along with XAUUSD the same setup is seen in USDJPY and USDCHF and can be utilized in constructing attractive high-leverage dual digitals.

In the above exhibit, below chart analyzes USD de-correlation dual digitals of type XAUUSD up & USDCCY up. While the discounts ticked lower over last few weeks the combinations invoking high beta G10 still offer very solid savings. That said, the mid pricing should be taken with a grain of salt as XAU x- vol liquidity continues to limit the tradable pool. With that liquidity constrain in mind we are willing compromise and consider EUR even as the XAUUSD – EURUSD correlations dropped precipitously since the beginning of April. With EURUSD ATMS strike showing better correlation levels than OTMS strikes (refer above chart) consider the following as a leveraged expression for a more forceful than expected medium term upside surprise in gold:

6M (XAUUSD > 5% & EURUSD < ATMS) @8/18 %USD, is at 50% discount to individual at-expiry digitals. Courtesy: JPM

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?