Softer vols may prove a momentary soft patch as the Dow Jones broke the symbolic threshold of 20000 last week, bears resume again claw back to 19885 during earlier European session, tripling in nominal value since the lows of 2009, markets seem wrapped up in a spell of euphoria that can only signal radiant optimism on US cyclical upturn and immense credit granted to Trump's emphatic "America First" agenda of protectionism: fiscal easing, infrastructure spending, and deregulation.

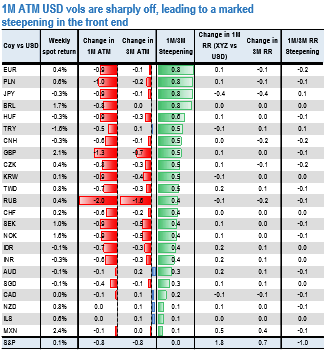

While DXY vols have been easing consistently since US polls results, now in equity markets, a decent start to the Q4 earnings season is further helping vols flirt with all-time lows. At 8.5, 1M S&P vol is just a few decimal points above the abnormally low trough of Jun-Jul 2014. While the price action in FX vols doesn’t suggest the same level of complacency, this softness in front end vols is spilling over to 1M USD vols and sending them sharply lower across the board (refer table).

Fed Chair Janet Yellen has backed a strategy for gradually raising rates, arguing in remarks a day before Trump’s inauguration last week the bank wasn’t behind the curve in containing inflation pressures but nevertheless can’t afford to allow the economy to run too hot. Yellen said wages had risen “only modestly” and manufacturing was operating well below capacity.

As March FOMC and the first round of a particularly disputed French presidential elections keep 3M vols firm, this is leading to a marked vol steepening. Such moves are a hallmark of either capitulation or opportunistic profit taking from investors who started the year with a long vol bias -many of them reluctantly as the position suffered from the frailty of garnering a broad consensus.

Long USD IMM positioning at 1yr highs have certainly played a catalyst role in this capitulation, and the upcoming Chinese New Year period of Asian market closures is likely adding to the mood.

The market vexation with front end USD vols is hardly justified by actual gamma performance, at least if one looks at vol swap returns YTD (refer above chart), and one would be more justified in judging EUR cross vols as expensive to hold (refer above chart). It is not the case that USD gamma is painfully underperforming as of yet, especially when a pair like GBPUSD is able to deliver its largest short squeeze rally since the Brexit vote.

Even USDJPY 1w vols are at the low range of expiries after BoJ’s inaction in the last meeting. Thus the vol softening looks more like temporary setback than a full-fledged vol cleanout, where there remain unresolved issues for global growth (how much growth will Trump's program actually deliver, how does an equity bull run reconcile with a Fed tightening cycle) and the spectrum of a tail-risk sell-off continues to loom over bond markets.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data