The lira may appear to have rallied since this Monday after the CBT Governor was fired last weekend by a presidential decree. But this is a misleading picture where a broader EM FX rally is masking the underlying tendency.

In the majority of circumstances, this does not have to be spelled out – but sometimes it is best to as bigger interpretations are involved. The USDTRY exchange rate had a close of 5.63 last Friday; it spiked up to 5.82 on Monday 8 July as the market digested the news of President Tayyip Erdogan removing CBT Governor Murat Cetinkaya via presidential decree. Later during the week, USD-TRY settled down around the 5.70 mark: this might give rise to the impression that the market has processed all available information on the future of Turkish monetary policy and has decided to take a favorable view of the lira outlook. But, such an interpretation would be quite misleading.

We should view lira movements within the context of broader risk sentiment, which improved markedly this week because of remarks made by Fed chair Powell which increased bets on a July rate cut. In fact, the lira lost ground against typical EM peers such as the South African rand and the Russian ruble. The lira gapped weaker after the announcement, and after a mild rebound during part of the week, has begun to move lower again, not higher.

Granted, no sharp lira sell-off has begun yet – there are good reasons why not – we discussed these in our FX Hotspot “Why did TRY react so little? And why is our TRY forecast so aggressive?”. But the matter of ‘trigger’ and ‘timing’ is a different point. The lira movements nowhere suggest that the market is not bothered about Turkish CB independence any longer. The FX market is not actually contradicting our downbeat prognosis. Rather, continued dovish developments, globally, are masking the underlying tendency. We forecast USDTRY to jump to 7.00 as soon as inflation data begin to disappoint again in Q4.

While the risk on the wave on the back of Powell's put swept from equity markets to high yielding FX but in light of the earlier mention broad-based FX vol setup (G10 and EM vols back to YTD low) shorter holding periods may be prudent.

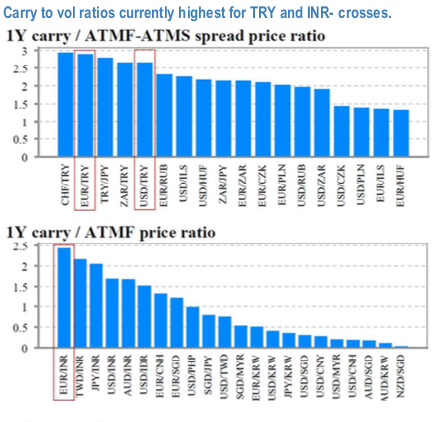

Carry/vol is the most prominent in TRY and INR crosses (refer above chart). Forward points are steep enough such that a 1Y ATMF strike stands to multiply its premium 2.5x if the spot were to simply stay unchanged over the next year.

EURINR vols are near the historical low, while the firing of the Central Bank governor in Turkey over the weekend encouragingly did not have a dramatic impact on TRY spot and volatility variables, aside from the early Monday morning gyrations. Thanks to the depressed skew to carry ratio, TRY-crosses are particularly favored in the form of ATMF- ATMS structures.

Simple vanilla structures such as 3M 6.30/6.10 EURTRY. Courtesy: JPM & Commerzbank

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices