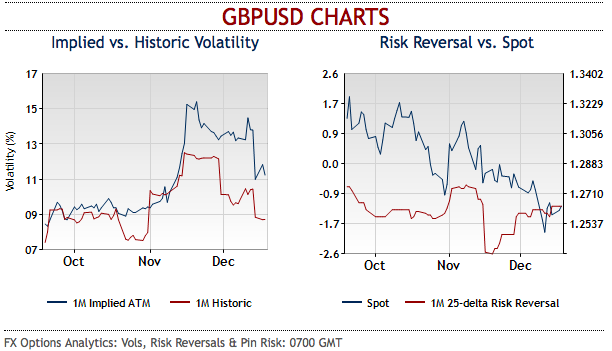

The recent dip in GBP volatilities on the options markets (see above charts) do not really make total sense.

Has the uncertainty concerning Brexit really fallen in the eyes of the market since the vote in the House of Commons was postponed? Of course, it was clear that Prime Minister Theresa May would lose the vote on her withdrawal agreement.

The Federal Reserve interest rate decision is the key set-piece on today’s market agenda. Recent statements from FOMC members have been interpreted as ‘dovish’ in nature, and understandably so, with Chair Powell suggesting that rate rises next year are likely to be more data dependent. A 25bps increase in the Fed funds rate is widely expected this evening.

On the other hand, Bank of England is also scheduled for its monetary policy which is most likely to maintain status quo. Today’s UK November inflation release likely to show a decline in both ‘headline’ and ‘core’ inflation. Inflation has fallen back closer to the BoE’s 2% target, with the waning impact of sterling’s post-referendum depreciation and recent decline in oil prices putting downward pressure on the year-on-year rates.

Short hedges through futures contracts: If you glance at the pricing of 1w ATM GBPUSD puts, it seems to be overpriced as there exists disparity between IVs and NPV. These options are overpriced 24% more than NPV.

Alternatively, on hedging grounds, shorting futures contracts of mid-month tenors were advocated, now we wish to uphold the same position as the underlying spot FX likely to slide southwards 1.2424 levels in the near terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Ore, Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -3 levels (which is absolutely neutral), and hourly USD spot index has bearish index is creeping at -70 (bearish) while articulating (at 11:23 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges