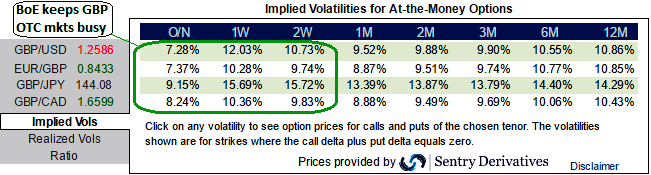

The ATM volatility of GBP crosses to spike crazily until next week’s BoE monetary policy meeting, We are expecting calm down a little after another roller-coaster ride in the GBP around the BoE meeting on next Thursday.

Volatility investors in GBP should consider buying OTM puts and/or being long of the smile convexity, against ATM volatility. But further cable weakness to come suggests building a directional and volatility position at the same time: the value of OTM puts will rise if the pair breaks below 1.25.

The positively skewed 2w IVs are signifying the option traders' interests in OTM put strikes, we, therefore, recommend buying a 2w risk reversal.

Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

As you can observe the vega of 2w ATM long call/put option position is 98 USD, as and when IV increases or decreases by 1%, you could see the corresponding increase or decrease by 98 USD in its option’s premium respectively.

Option Trade Recommendation:

Go long in 2 lots of 2w ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the same expiry, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

When to use this strategy: Suppose any negative surprising news from next week’s BOE meeting that could revolve GBPUSD and you want to take your odds on downside risks – you can trade a Strip. Please be noted that technically it is not required that you buy only ATM options. You can probably buy options from any strike but both calls and puts should be of the same strike.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One